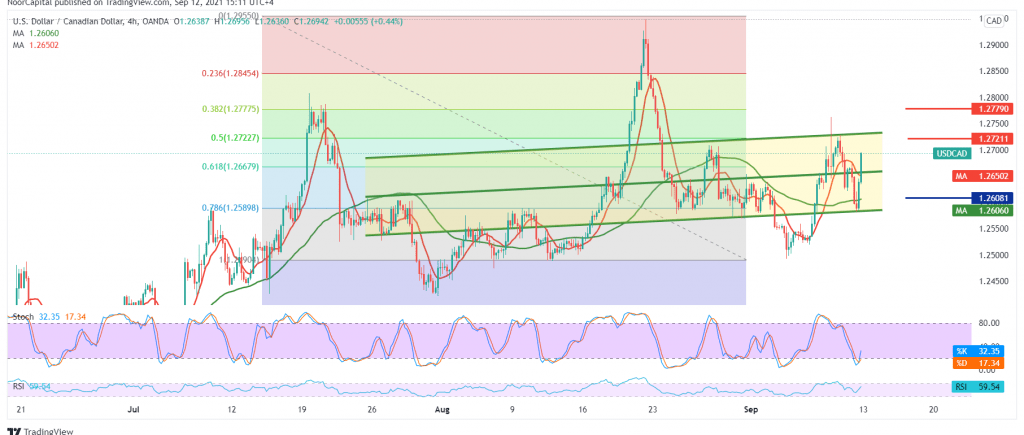

During the previous analysis, the Canadian dollar retested the required support level at 1.2580, recording a low at 1.2600, benefiting from the retest scenario published in the last analysis to rebound and retest 1.2720 resistance.

Technically, and carefully looking at the 240-minute chart, we find prices stable above 1.2670, 61.80% Fibonacci correction, accompanied by the positive motive for the 50-day moving average.

Therefore, the bullish bias is likely today, knowing that the confirmation of breaching 1.2720, 50.0% correction, increases the strength of the daily bullish trend so that we will be waiting for 1.2770, a first target, and then 1.2840 the next station.

Remember that activating the bullish scenario depends on trading stability above 1.2600/1.2580, and breaking it will postpone the chances of rising. We are witnessing a limited bearish slope that targets retesting 1.2545 and 1.2500 before attempts to rise again.

| S1: 1.2620 | R1: 1.2720 |

| S2: 1.2545 | R2: 1.2770 |

| S3: 1.2500 | R3: 1.2845 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations