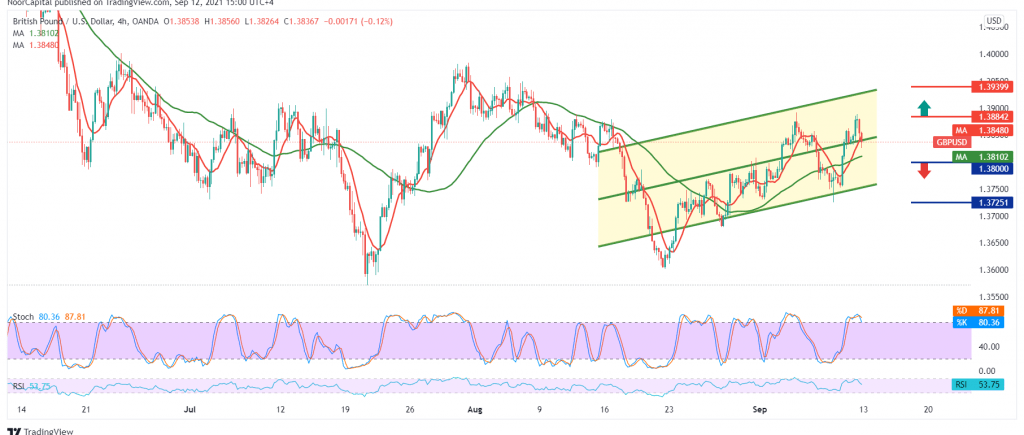

The British pound achieved the first target at 1.3890, to record the highest price at 1.3890, which formed a strong resistance level that forced the pair to approach a retest of 1.3810.

On the technical side, today, we find the 50-day moving average that is still holding the price and staying near the support level of 1.3810/1.3800, adding more strength to this level, and on the other hand, there are negative signs that started to appear on the stochastic indicator on the 4-hour time frame.

With technical signals conflicting, we will stand aside for the moment to obtain a high-quality deal, waiting for one of the following scenarios:

In case the break of 1.3810/1.3800 is confirmed from here, we may witness a bearish bias, its initial target 1.3765, while its official target lies around 1.3700.

Reactivating the long positions, we need to witness a jump and rise of the price above 1.3890, and this is a catalyst that increases the probability of touching 1.3930 and 1.3970, respectively.

| S1: 1.3800 | R1: 1.3890 |

| S2: 1.3765 | R2: 1.3940 |

| S3: 1.3720 | R3: 1.3980 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations