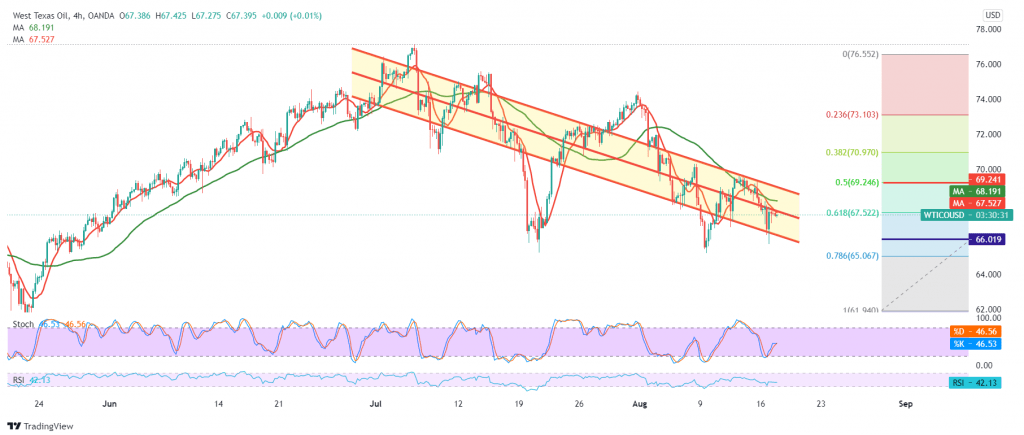

US crude oil futures prices managed to achieve the official bearish targets that are required to be touched during the last analysis at the price of 66.00, to record the lowest price of 65.73.

Technically, the simple moving averages are still an obstacle to oil prices, and this comes in conjunction with the clear negative features on the stochastic indicators.

From here, with steady intraday trading below 68.10, and most importantly 68.40, the bearish trend remains valid and active, targeting 66.00, and breaking it increases the strength of the bearish trend, to be waiting for the next 65.00 station that extends its targets to visit 64.65.

Confirmation of breaching the resistance level of 68.40 is able to completely thwart the bearish scenario, and crude oil will recover again, with a target of 69.25. In general, we continue to suggest the overall bearish trend unless we witness trading above 69.25.

| S1: 66.00 | R1: 68.40 |

| S2: 64.65 | R2: 69.45 |

| S3: 63.60 | R3: 70.75 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations