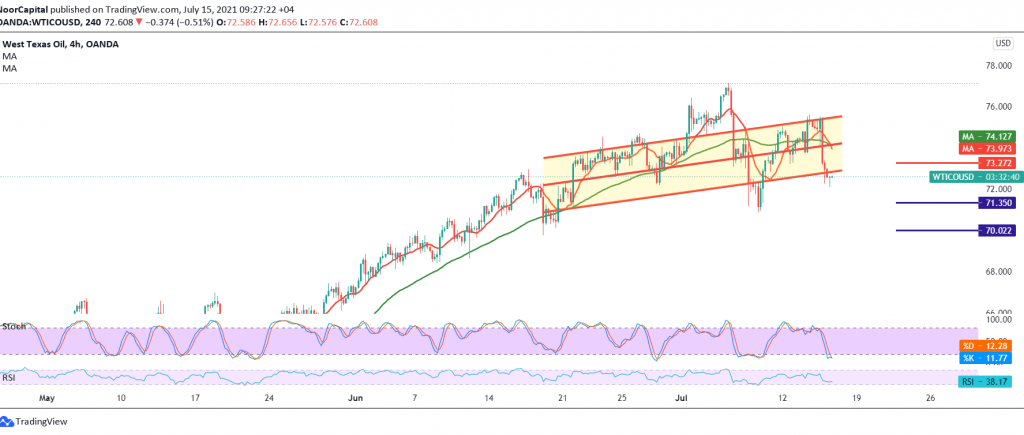

US crude oil futures prices found a strong resistance near our awaited target at 75.70, to settle for recording the highest level at 75.51. To remind, we mentioned during the last report that the bullish trend depends on the stability of trading above 73.30.

Technically, the current moves are witnessing stability below 73.30. We also find that the simple moving averages constitute an obstacle in front of the price, accompanied by the RSI gaining bearish momentum.

Therefore, we may witness a return of the bearish corrective bias again, with the first target of 71.35/71.30, and we should pay close attention to this level due to its importance to the general trend in the short term, and breaking it will extend oil losses so that the path is directly open towards 70.00 initially.

Skipping up and moving above the previously broken support, which is now turned to the resistance level of 73.30, invalidates the activation of the suggested bearish scenario, and we may witness attempts to rise, targeting 74.70.

| S1: 71.35 | R1:74.70 |

| S2: 70.00 | R2: 76.80 |

| S3: 67.90 | R3: 78.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations