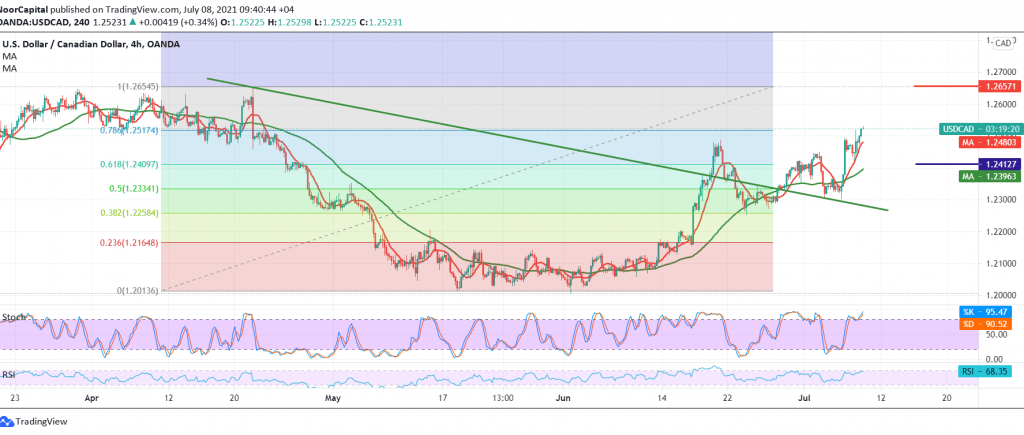

The Canadian dollar achieved noticeable gains during the previous session’s trading, heading towards the awaited bullish correction tendency at 1.2410, to extend its gains, touching a high at 1.2530.

Technically, and with the pair’s success in confirming the breach of 1.2410, the 61.80% Fibonacci retracement, which has now turned into a support level, in addition to the positive motive for the 50-day moving average.

This increases the possibility of completing the bullish corrective slope with the first target of 1.2565, then 1.2600; targets may extend later to visit 1.2670. In general, the trend is to the upside unless we witness a trading volume and a daily closing below 1.2410.

| S1: 1.2455 | R1: 1.2565 |

| S2: 1.2380 | R2: 1.2600 |

| S3: 1.2330 | R3: 1.2670 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations