US crude oil futures prices achieved a series of gains amid the expected bullish context, touching the first target at 76.40, recording its highest level at 74.74.

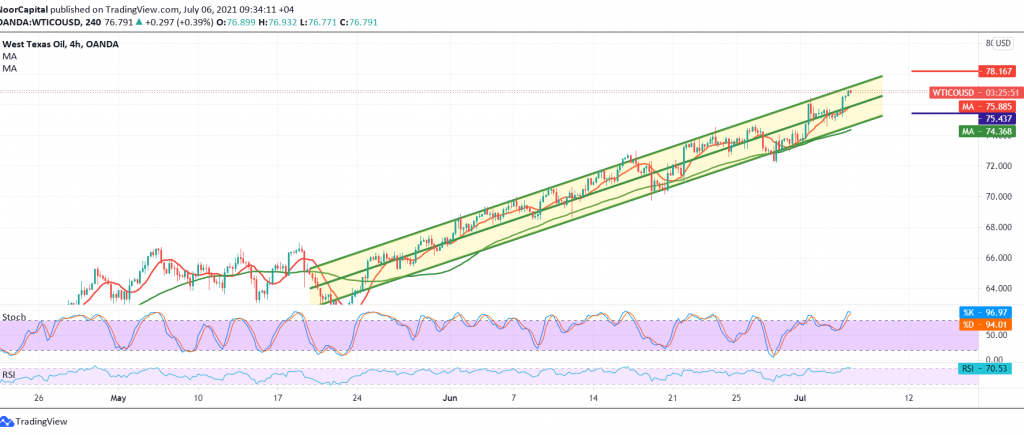

Technically, still trading within the bullish channel shown on the chart, accompanied by the positive impetus of the 50-day moving average, which supports the bullish price curve.

From here, the bullish bias is preferable, targeting 77.50/77.60 as the first target, considering that confirming the price breaking through the mentioned level extends the oil gains to the 78.00/78.20 next key level.

Activating the bullish scenario requires oil prices to maintain trading above 75.50, noting that trading below 75.50 postpones the chances of a rise but does not cancel them, with an anticipated downside bias, targeting 74.30 before rising again.

| S1: 75.50 | R1:77.55 |

| S2: 74.25 | R2: 78.20 |

| S3: 73.50 | R3: 79.50 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations