Trades tended to the positive within the context of the retest that is required to be achieved on short intervals at 1.1975 so that the euro was satisfied with recording its highest level at 1.1952.

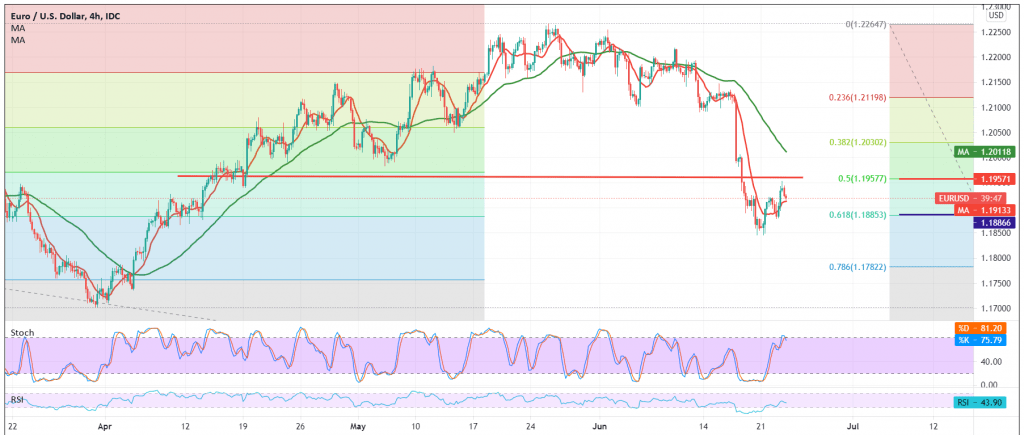

Technically, and by looking at the chart, the 50-day moving average is still pressuring the price from above, as we find stochastic started to gradually lose the bullish momentum.

Although we tend to be negative in our trading, we prefer to wait until confirming the breach of the 1.1880 support level represented by the 61.80% Fibonacci correction as shown on the chart, and this facilitates the task required to visit 1.1845, a first target, and then 1.1810, an initial official station for the current downside wave.

Trading above 1.1975 50.0% correction leads the euro to recover again, so we will be waiting for 1.2040.

| S1: 1.1800 | R1: 1.1960 |

| S2: 1.1745 | R2: 1.2060 |

| S3: 1.1650 | R3: 1.2120 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations