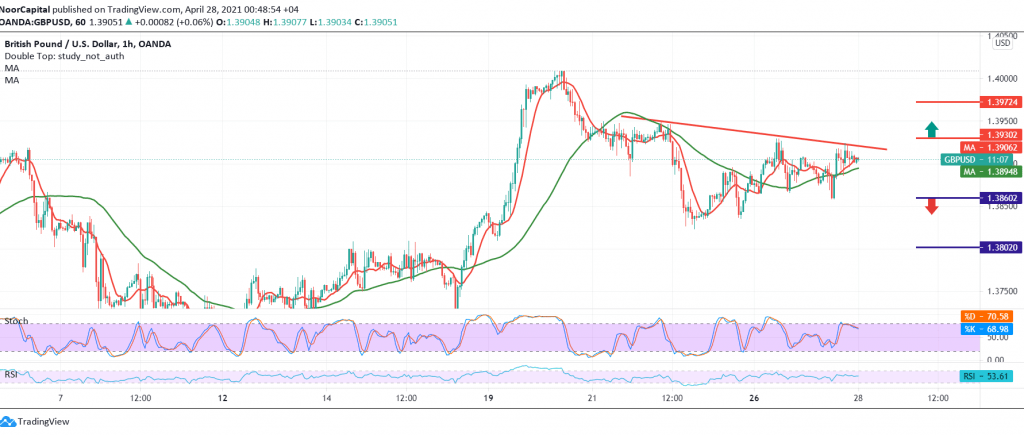

Sideways trading was capped from the bottom above the support level 1.3860, and from below at the resistance level 1.3920, without any change on the technical side.

With a closer look at the 60-minute chart, we find the pair trading negatively, accompanied by negative signs coming from the stochastic indicator.

Which makes us tend to be negative, but cautiously, during the coming hours to re-test 1.3860, and the price should be carefully monitored around those levels due to their importance for the general trend in the short term, and breaking them puts the pair under strong negative pressure targeting 1.3800.

If the British pound was able to breach 1.3930/1.3935 from here, we might witness a bullish path targeting 1.3960/1.3970, and gains may extend later towards the psychological barrier of 1.4000.

| S1: 1.3865 | R1: 1.3930 |

| S2: 1.3830 | R2: 1.3960 |

| S3: 1.3790 | R3: 1.4000 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations