US crude oil futures prices jumped to achieve strong gains last Friday, attacking the psychological barrier of $68 per barrel.

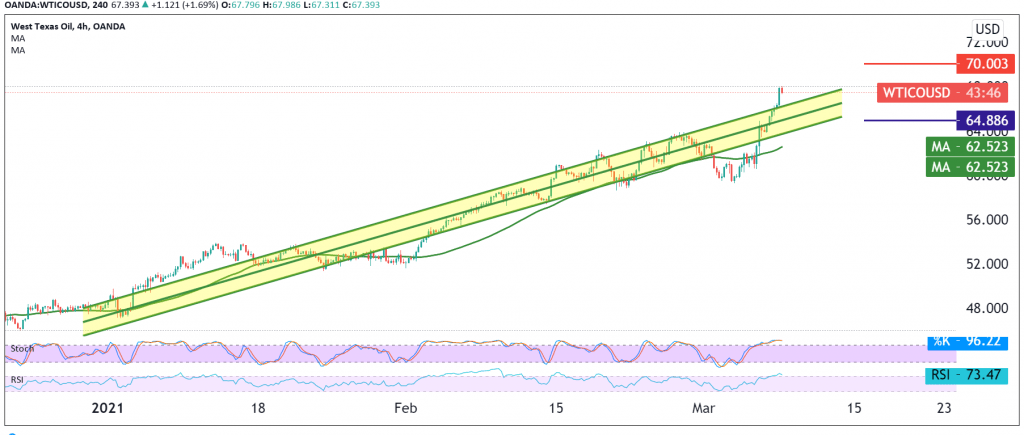

Technically, we find that the price opened its weekly trading on a rising gap, and with a closer look at the chart, we find that the RSI indicator continues to obtain bullish momentum, accompanied by the continuation of the positive stimulus coming from the 50-day moving average.

With the price remaining stable above 65.90, this encourages us to maintain our positive expectations, noting that the breach of 69.00 increases and accelerates the strength of the bullish trend to reach 70.00, the awaited station and its targets extend towards 70.50.

From the bottom, trading below 65.80 will postpone bullish chances, and we are witnessing a bearish bias targeting a re-test of 64.80 before attempting to rise again.

Note: The level of risk may be high today.

| S1: 64.80 | R1: 69.00 |

| S2: 62.25 | R2: 70.55 |

| S3: 60.65 | R3: 73.10 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations