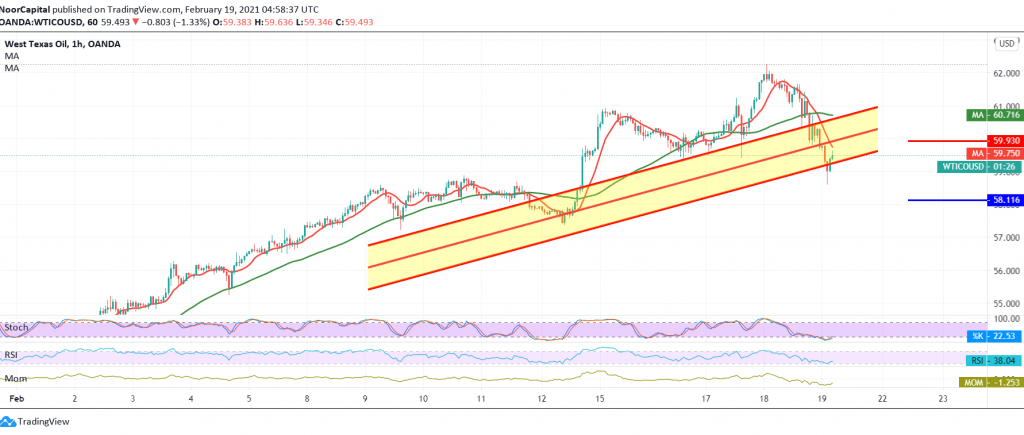

Strong selling dominated the futures price of US crude oil during the previous session’s trading, nullifying the positive outlook as we expected, in which we depended on the stability of the price above the level of 60.30.

Technically, the success of oil in breaching the support level of 59.90 / 60.00 supports the daily negativity, and we find that the RSI indicator started to lose the bullish momentum.

Therefore, the bearish bias is likely today, targeting 58.10, a first target, noting that breaking the aforementioned level extends oil’s losses, so the way is directly open towards 57.50.

From the top, the return of stability above 60.00, able to thwart attempts to decline, and oil regains its recovery again, with an initial target of 61.30.

| S1: 58.10 | R1: 61.45 |

| S2: 56.75 | R2: 63.30 |

| S3: 54.90 | R3: 65.70 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations