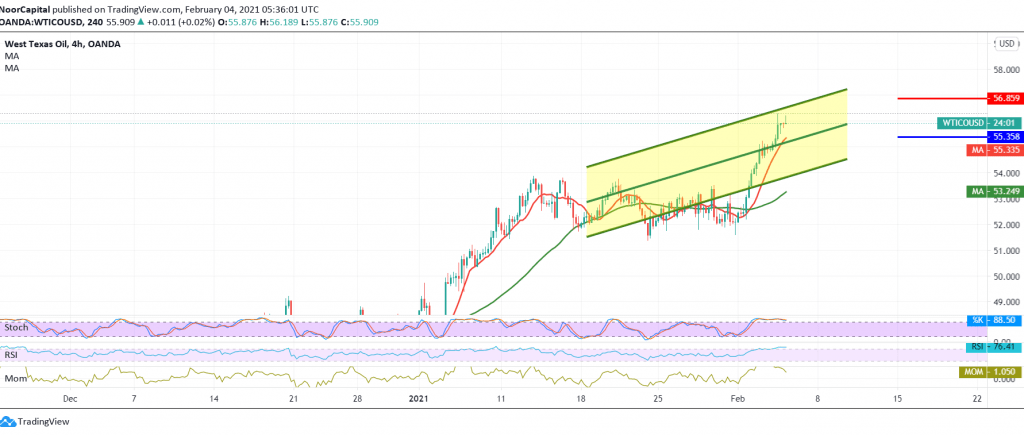

US crude oil futures succeeded in achieving the positive outlook, as we expected, achieving strong gains touching our final target at 56.30, recording a high of 56.31.

Technically, we find the price stable above the support floor of 54.70, and the 450-day moving average continues to hold the price from below.

On the other hand, negative features started to dominate the stochastic due to an intraday overbought pattern. Therefore, we may witness a slight bearish bias during the coming hours, aiming at re-testing the support level of 55.50 / 55.40, and it may extend to 54.70 before rising again.

Trading above 56.30 completely negates the aforementioned retest technique and leads oil to continue the official bullish path, whose targets are around 56.90 and 57.30.

Note: the expected slight bearish bias does not contradict the daily bullish trend.

| S1: 54.70 | R1: 56.20 |

| S2: 54.050 | R2: 56.90 |

| S3: 53.20 | R3: 57.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations