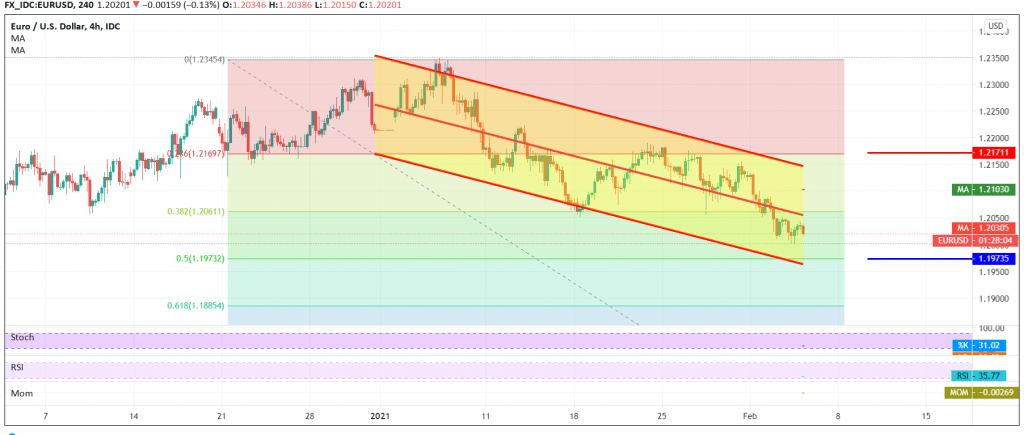

The euro continues its bearish path against the US dollar, continuing its negative crawl towards the second official leg of 1.2000.

On the technical side today, and with a closer look at the 240-minute chart, we find that the moving average continues to support the bearish curve of prices, and we find the RSI indicator continues to provide its negative signals.

Therefore, with the continuation of trading below the previously broken support and now converted to the resistance level 1.2065, the correction of 38.20%, we will maintain our negative outlook, completing towards the third official target of 1.1970, a correction of 50.0%, and we must monitor the price behavior around this level because breaking it extends the losses of the pair opening the way towards 1.1730 .

In general, we continue to suggest the bearish trend as long as trading remains stable below the resistance level of 1.2170, retracing 23.60%, as shown on the chart.

| S1: 1.2000 | R1: 1.2065 |

| S2: 1.1970 | R2: 1.2100 |

| S3: 1.1930 | R3: 1.2135 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations