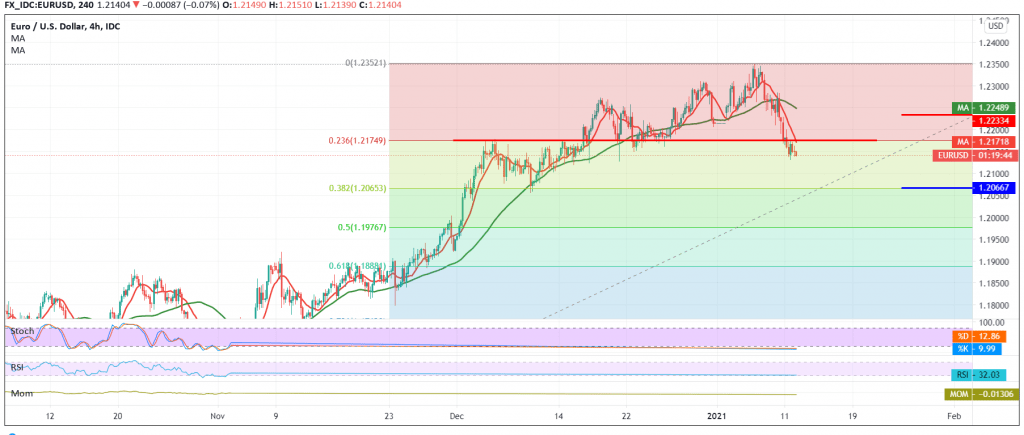

The euro continues its gradual decline against the US dollar within the expected bearish context, touching the first target mentioned in the previous analysis at 1.2130, to hit its lowest level during the previous trading session at 1.2131.

Technically, we find that the pair ended its daily transactions below the pivotal resistance at 1.2170 represented by the 23.60% Fibonacci correction as shown on the chart, in addition to the continuation of the negative pressure coming from the simple moving averages.

Consequently, we will maintain our negative outlook, continuing towards completing the bearish correction to visit 1.2105 / 1.2100, and then 1.2065 38.20% retracement, a next stop. It should also be noted that confirming the recent breakout extends the pair’s losses, opening the way directly towards 1.2010.

From the top, surpassing the upside resistance level 1.2170 / 1.2175 delays the chances of a reversal, but does not cancel them, and we are witnessing a slight bullish bias aimed at re-testing 1.2210 before resuming the decline again.

| S1: 1.2105 | R1: 1.2205 |

| S2: 1.2065 | R2: 1.2265 |

| S3: 1.2010 | R3: 1.2300 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations