The euro continues to pressure the US dollar to continue achieving gains, heading to visit the first target mentioned in the previous analysis, located at 1.2000, posting a high of 1.2003.

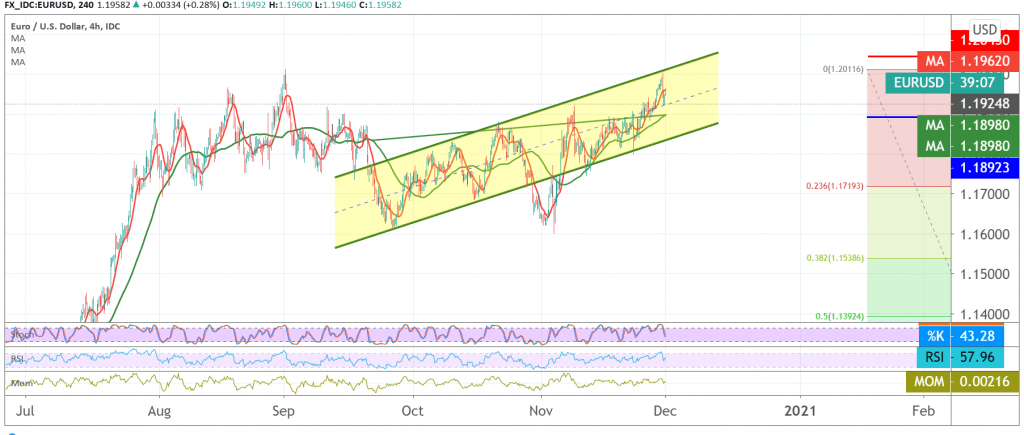

Technically, the pair met psychological barrier level to witness a slight bearish tendency, and with a closer look at the 240-minute chart, we find the 50-day simple moving average continues to hold the price from below and meets near 1.1890 and adds more strength, this comes in conjunction with clear positive signs on RSI.

Consequently, we will maintain our positive outlook, bearing in mind that confirming the breach of the psychological barrier of 1.2000 is a catalyst extending the Euro’s gains, opening the way to a visit of 1.2040, and then 1.2080, and the gains may extend to a visit of 1.2130 late

On the downside, trading again below 1.1880, delays the bullish chances, but does not negate it, and we may witness a re-test of the 1.1820 support level before resuming the rise again.

| S1: 1.1930 | R1: 1.2000 |

| S2: 1.1880 | R2: 1.2040 |

| S3: 1.1820 | R3: 1.2080 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations