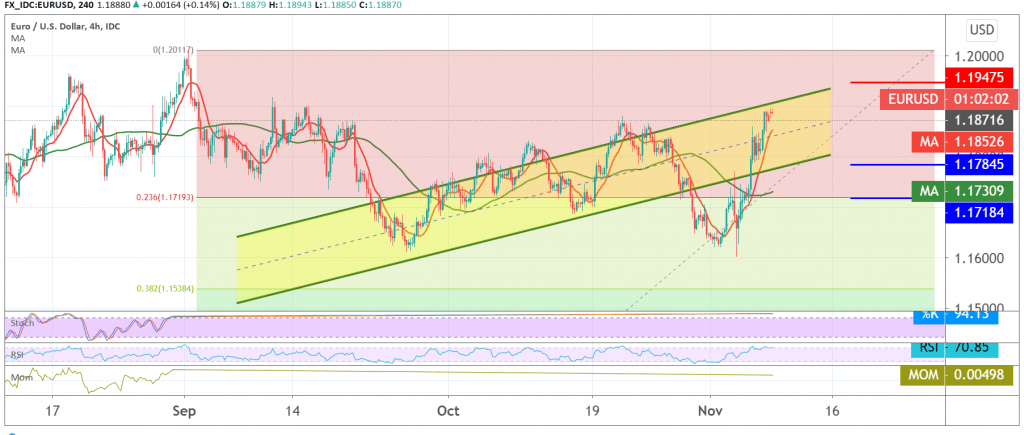

The single European currency continues to rise against the US dollar within the expected bullish path last Friday, surpassing the first target required to be achieved during the previous analysis, 1.1870, to hit the session high at 1.1895.

Technically, the moving averages continue to support the general bullish trend, in addition to trading stability in general above the support level of 1.1830 / 1.1825.

Consequently, we will maintain our positive expectations completing towards the second target 1.1925 / 1.1930, a second leg, bearing in mind that surpassing the upside and rising above 1.1945 extends the EUR’s gains, so the way is directly open towards 1.2000 / 1.2020.

From below, consolidating again below 1.1820, and the most important 1.1785 is able to stop the bullish scenario, and we may witness a re-test of 1.1720, a 23.60% correction, as shown on the chart.

| S1: 1.1825 | R1: 1.1925 |

| S2: 1.1760 | R2: 1.1960 |

| S3: 1.1720 | R3: 1.2020 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations