The U.S. dollar posted weekly gains, supported by hawkish Federal Reserve commentary and improving trade relations between Washington and Beijing. The dollar index, which measures the greenback against a basket of major currencies, rose 0.4% to a three-week high at the start of last week and ended the week up 0.2%.

This strength was driven by rising Treasury yields and Fed Chair Jerome Powell’s statement that a December rate cut is “not guaranteed.” Additional support came from regional Fed officials who opposed further easing, citing strong economic momentum and persistent inflation.

Markets also welcomed news of an extended tariff truce and reduced trade restrictions between the U.S. and China, which boosted global economic sentiment. Positive U.S. data—including rising home prices and a stronger-than-expected Chicago PMI—further reinforced the dollar, despite ongoing pressure from the government shutdown.

Central Bank Moves

The Federal Reserve cut its benchmark interest rate by 25 basis points last Wednesday, bringing the target range to 3.75%–4.00%, in line with market expectations. Alongside the rate decision, the Fed discussed the future of its quantitative tightening program, which involves managing its balance sheet by not reinvesting proceeds from maturing assets.

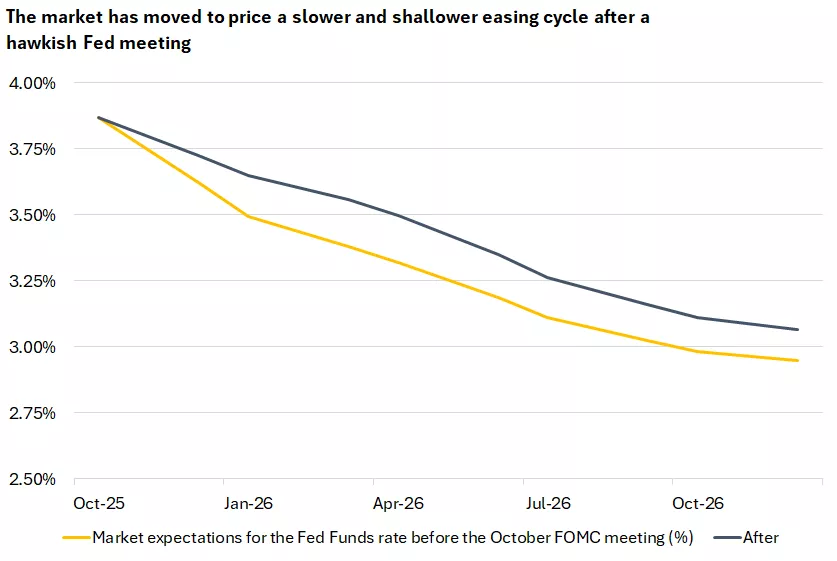

However, Powell’s remarks during the post-meeting press conference struck a more cautious tone. He emphasized that there was wide disagreement among committee members about the path forward in December, stating that another rate cut “is far from certain.” He added that many members felt it was prudent to wait at least one more cycle before making further moves. As a result, market expectations for a December rate cut dropped from 90% to 67%, according to the CME FedWatch tool.

Meanwhile, the European Central Bank announced on October 30 that it would keep key interest rates unchanged. The deposit rate remains at 2.00%, the refinancing rate at 2.15%, and the lending rate at 2.40%. The ECB noted that inflation remains close to its 2% medium-term target and that its inflation outlook has not changed significantly.

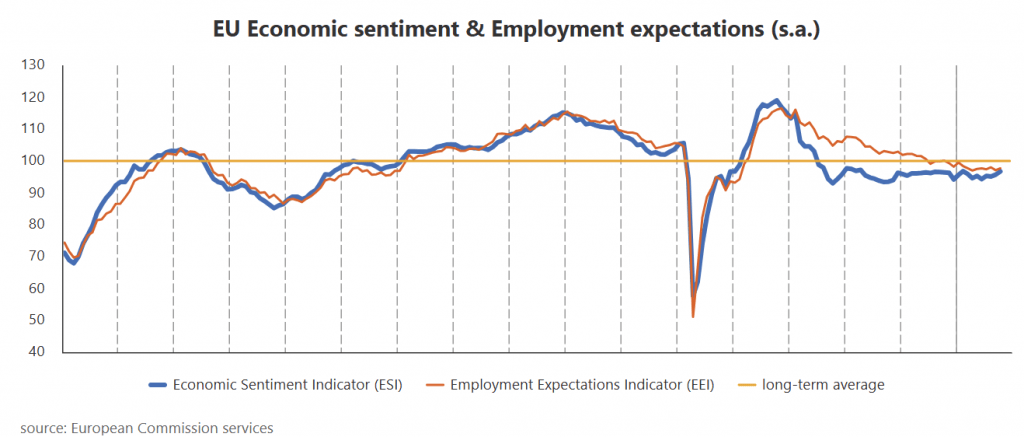

ECB President Christine Lagarde stated that the eurozone economy remains in good shape despite global challenges. She noted that downside risks to growth have eased, although uncertainty around inflation remains high. Lagarde highlighted ongoing pressure on the manufacturing sector due to tariffs and a persistent gap between domestic and external demand. She added that household savings remain unusually high and will continue to support consumption, while labor demand is starting to soften, with wage growth expected to moderate.

Euro Posts Weekly Losses Despite ECB Support

The euro fell 0.8% against the dollar over the week, hitting a two-week low, weighed down by dollar strength and hawkish Fed signals. However, the euro pared some losses after the ECB held its deposit rate steady at 2.00%, in line with expectations.

Supporting the euro were upbeat economic indicators: eurozone GDP grew 0.2% month-over-month and 3.0% year-over-year in Q3; economic sentiment rose to 96.8 points, a 2.5-year high; and German inflation held at 0.3% monthly and 2.3% annually.

Lagarde reiterated that the eurozone economy is resilient, though inflation uncertainty persists. She noted that a stronger euro could help ease inflation, while rising defense spending may push it higher.

Equities Defy Seasonal Headwinds and Fed Caution

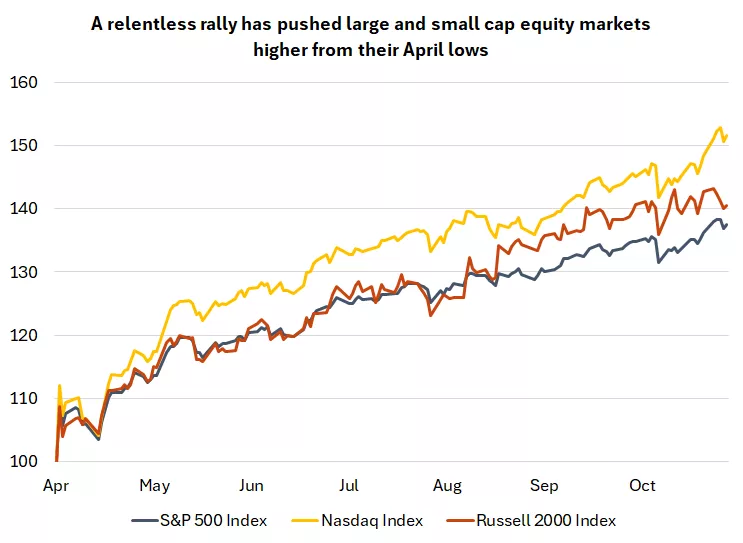

Global equity markets ended October near record highs, shrugging off seasonal volatility and hawkish Fed messaging. Despite Powell’s warning against assuming a December rate cut, which triggered bond market sell-offs, investors remain optimistic about future easing.

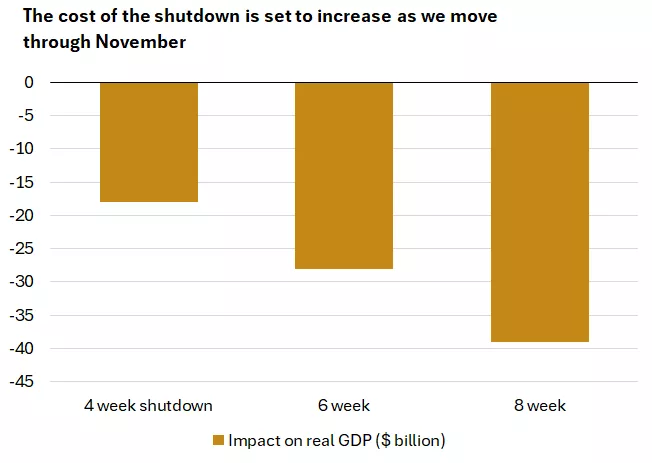

A high-level meeting between Presidents Trump and Xi helped ease trade tensions, reinforcing confidence in the stability of the U.S.–China economic relationship. Although the U.S. government shutdown is nearing a record duration, markets have yet to show significant concern. A political breakthrough in November could shift sentiment, but prolonged disruption may increase market sensitivity.

Corporate earnings came in stronger than expected, bolstering confidence in profitability. While tech results were mixed, enthusiasm around AI remains strong. Despite elevated volatility in October, markets posted solid gains. November may bring fresh challenges amid signs of investor fatigue, but the outlook for 2026 remains positive, with any pullbacks seen as buying opportunities.

Gold Extends Weekly Losses

Gold prices fell sharply for a second consecutive week, dropping 2.7% to close Friday at $4,002 per ounce—down from $4,111 the previous week and marking a one-month low. The decline was driven by heavy selling from investors unwinding long positions after a two-month rally.

Safe-haven demand weakened following the preliminary U.S.–China trade agreement, prompting reduced holdings in gold and silver. Nonetheless, several supportive factors remain: the ongoing U.S. government shutdown, geopolitical risks, central bank purchases, and political pressure on Fed independence. Last week’s rate cut by the FOMC also lends support to precious metals.

Additionally, weaker-than-expected U.S. economic data has reinforced expectations for further rate cuts, typically a bullish signal for gold.

Bitcoin Posts Steep Weekly Losses Amid Policy and Market Uncertainty

Bitcoin recorded significant weekly losses for the period ending October 31, weighed down by a combination of negative factors. Chief among them was the ongoing U.S. government shutdown, now entering its sixth week, raising concerns about broader economic fallout—including a potential rise in the U.S. unemployment rate to 4.7%.

Cryptocurrencies also came under pressure following comments from Federal Reserve Chair Jerome Powell, who signaled a pause in rate cuts at the upcoming December meeting. Additionally, expectations of a preliminary trade agreement between the U.S. and China dampened demand for risk assets like Bitcoin. While the agreement hinted at greater global trade stability, the outcome of the summit between President Donald Trump and Chinese President Xi Jinping fell short of market expectations, which had hoped for a more comprehensive deal.

Despite recent setbacks, several positive factors could support a rebound in Bitcoin and other digital assets in the coming week. The Fed’s recent rate cut remains a potential tailwind, as lower borrowing costs tend to benefit risk assets like cryptocurrencies.

Another notable development was the launch of the first exchange-traded fund (ETF) linked to Solana, marking a significant step toward broader institutional adoption of alternative digital assets. Additionally, stronger-than-expected corporate earnings have helped restore investor confidence in financial markets, despite mixed results from major tech firms. With continued momentum in the AI sector, the outlook for 2026 remains optimistic, and any market pullbacks are increasingly seen as buying opportunities.

Japanese Yen Sees Weekly Losses Despite Political Support

The Japanese yen weakened early in the week following reports that the government is preparing a new stimulus package, including tax cuts and direct financial support. This reinforced expectations that Japan will maintain its ultra-loose monetary policy.

However, the yen later recovered, gaining 0.52%, supported by U.S. President Donald Trump’s public praise of Japan’s new leadership and official reassurances that the government is monitoring the impact of yen weakness. A 0.2% decline in the U.S. dollar, driven by expectations of further Fed rate cuts, also helped lift the yen.

Toward the end of the week, the Federal Reserve cut interest rates by 25 basis points. Yet Powell’s post-meeting remarks suggested a more cautious stance, indicating that another cut in December is far from certain. Several Fed officials echoed this sentiment. Kansas City Fed President Jeff Schmid said he voted against the latest cut, citing a balanced labor market and persistent inflation. Dallas Fed President Lorie Logan and Cleveland Fed President Beth Hammack also expressed reluctance to ease further without clear signs of economic slowdown.

The yen remains influenced by a mix of domestic stimulus measures and international political dynamics, with investors closely watching Japan’s next moves.

Central Bank Policy Updates

At its October meeting, the Federal Reserve lowered its benchmark interest rate by 25 basis points to a range of 3.75%–4.00%, in line with market expectations. The Fed also discussed the future of its quantitative tightening program, which involves reducing its balance sheet by not reinvesting maturing assets.

However, Fed Chair Jerome Powell struck a more cautious tone during the post-meeting press conference. He noted a wide range of opinions among committee members regarding the December outlook, stating that another rate cut is “far from certain.” Powell emphasized that many members believe it would be prudent to wait at least one more cycle before making further changes. As a result, market expectations for a December cut dropped from 90% to 67%, according to the CME FedWatch tool.

Meanwhile, the European Central Bank announced on October 30 that it would keep all key interest rates unchanged. The deposit rate remains at 2.00%, the main refinancing rate at 2.15%, and the lending rate at 2.40%. The ECB reaffirmed that inflation remains close to its 2% medium-term target and that its inflation outlook has not changed significantly.

ECB President Christine Lagarde stated that the eurozone economy remains in good shape despite global challenges. She noted that downside risks to growth have eased, though inflation uncertainty remains elevated. Lagarde highlighted ongoing pressure on manufacturing due to tariffs and a persistent gap between domestic and external demand. She also pointed to strong household savings as a key driver of consumption, while warning that labor demand is softening and wage growth is expected to moderate.

Looking Ahead: Key Events This Week

This week, markets will focus on critical U.S. employment data—one of the most important indicators of labor market health and a key input for the Fed’s policy decisions. However, if the government shutdown continues, the release of these figures could be delayed, adding further uncertainty to the Fed’s decision-making process.

Also on the calendar are a series of Purchasing Managers’ Index (PMI) reports from the Institute for Supply Management, which may also be affected by the shutdown. In corporate news, several major companies in the tech and pharmaceutical sectors are set to report Q3 earnings, including Oracle and Novo Nordisk.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations