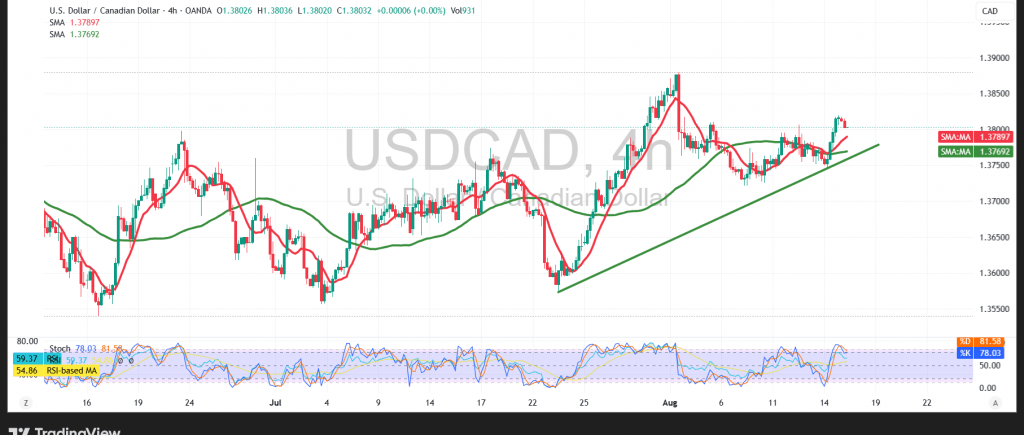

An upward trend took hold of the USD/CAD pair after several sessions of sideways movement, with the pair reaching its highest level in the previous session at 1.3820.

Technical Outlook – 4-hour timeframe:

Following yesterday’s rise, intraday price action is showing a natural pullback, yet the pair remains firmly above the 50-period simple moving average, which continues to serve as strong support. The Relative Strength Index (RSI) has also exited overbought territory, signaling the potential for continued upward attempts.

Probable Scenario:

Bullish Scenario: As long as the price holds above 1.3760, the bias remains to the upside, targeting 1.3835 as the first resistance, followed by 1.3865 as the next objective.

Bearish Scenario: A decisive break below 1.3750 would reintroduce negative pressure, with downside targets at 1.3720 and then 1.3685.

Fundamental Note:

Today’s session features high-impact US economic releases, including retail sales, preliminary Michigan consumer confidence, and preliminary Michigan inflation expectations, which could trigger notable market volatility.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations