An upward trend has dominated US crude oil futures, with prices attempting to recover losses from previous sessions.

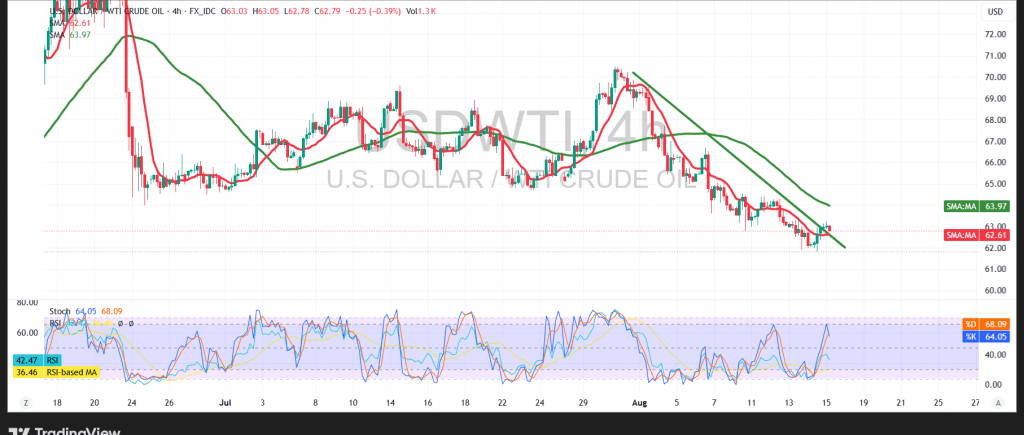

Technical Outlook – 4-hour timeframe:

US crude has established solid support at $62.00, while the 50-period simple moving average continues to act as dynamic resistance from above. The Relative Strength Index (RSI) is showing overbought conditions relative to price movement, suggesting the possibility of negative divergence, despite the price managing to break above a minor descending trend line on the chart.

Likely Scenario:

It is preferable to monitor price behavior until a clearer signal emerges, with two possible outcomes in focus. A confirmed close above the 63.40 resistance could open the door for gains toward 64.00, with a possible extension to 64.70. Conversely, a break below 62.00 would see the broader downtrend regain control, targeting 61.25 as the next support.

Fundamental Note:

Today’s trading session includes high-impact US economic releases such as retail sales, preliminary Michigan consumer confidence, and preliminary Michigan inflation expectations, which could lead to significant price swings.

Warning: Risks remain high amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations