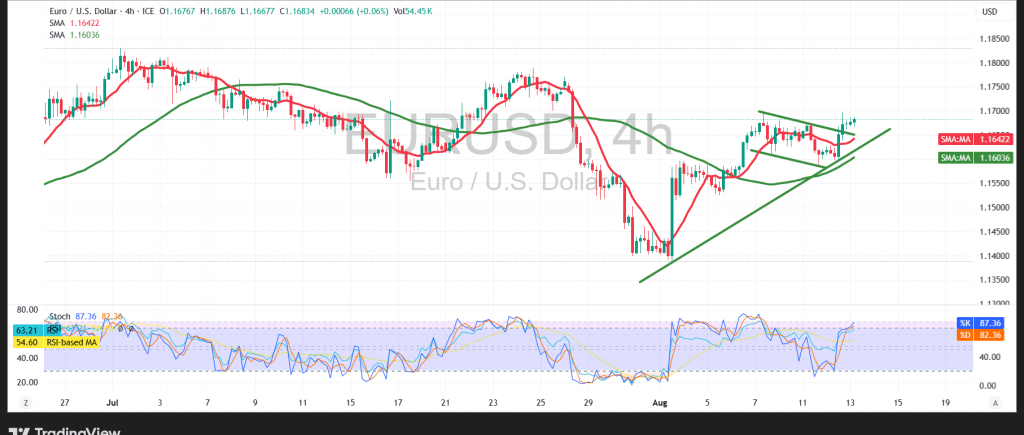

The euro continues to record gradual and quiet gains against the US dollar, approaching a breakout above the psychological barrier of 1.1700 after touching a high of 1.1697.

Technical Outlook – 4-hour timeframe:

Technical indicators continue to support the bullish bias, with the 50-period simple moving average acting as a dynamic support level. Price action also remains comfortably above a minor ascending trend line, reinforcing upward momentum.

However, the Relative Strength Index (RSI) has entered overbought territory, which may cap the upside in the short term.

Probable Technical Scenario:

The pair may witness an intraday pullback before resuming its upward trajectory, with the first resistance seen at 1.1720, followed by a key level at 1.1760.

Conversely:

A loss of momentum below 1.1620 could trigger renewed selling pressure. A break of this support may lead to a decline toward initial support at 1.1565, followed by a potential second support at 1.1525.

Warning: Risks remain elevated amid ongoing trade tensions, and all scenarios should be considered.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations