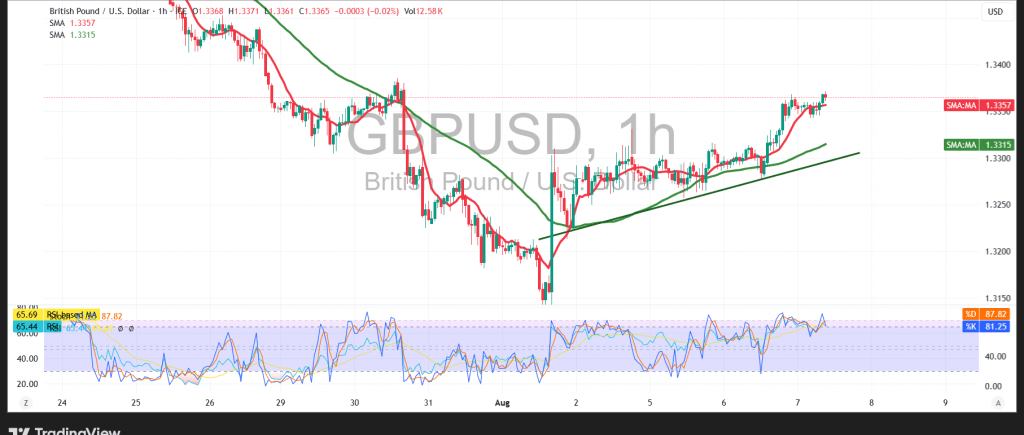

The British pound posted strong gains against the U.S. dollar in the previous session, in line with the bullish outlook highlighted in our prior report. The pair successfully reached the projected technical target at 1.3360, recording a session high of 1.3371.

Technical Outlook:

Intraday data shows continued bullish momentum, supported by price stability above the key support level at 1.3300. The pair also remains above the 50-period Simple Moving Average (SMA), which continues to act as dynamic support. However, early signs of weakening momentum are emerging on the Relative Strength Index (RSI), which has begun to show bearish divergence—indicating a potential slowdown in the pace of gains.

Probable Scenario:

As long as the pair holds above the 1.3300 support level, the bullish outlook remains intact. A continued move higher could see the pair targeting the 1.3400 resistance level, followed by an extended push toward 1.3440.

Alternative Scenario:

A break below the 1.3300 support level would likely shift momentum to the downside, exposing the pair to potential declines toward 1.3250, with further support at 1.3210.

Key Event Risk – High Volatility Expected:

Today, traders should prepare for increased volatility as the market awaits several highly influential economic events from the U.K., including:

- Bank of England Interest Rate Decision

- Monetary Policy Report

- MPC Official Bank Rate Votes

- Monetary Policy Summary

These events may significantly impact GBP pairs and short-term market sentiment.

Warning:

The current risk environment remains elevated due to ongoing global economic and geopolitical tensions. All scenarios are possible, and traders are strongly advised to implement robust risk management strategies.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations