The trading week ending July 29 was marked by significant market-moving events, most notably the Federal Reserve meeting, labor market and inflation data, U.S. economic growth figures, and developments in the Trump administration’s trade policy.

The Federal Reserve opted to keep interest rates unchanged last Wednesday, while signaling a continued inclination toward maintaining elevated rates over the coming period. The central bank justified its decision by citing persistent inflationary risks, driven in part by new tariff measures.

U.S. employment data came in below expectations, negatively impacting the performance of both the U.S. dollar and equities listed on the New York Stock Exchange.

Additional releases included U.S. growth figures, consumer confidence readings, and the Personal Consumption Expenditures (PCE) Index—all of which carry substantial weight in shaping current and future price movements of assets traded in global financial markets.

Federal Reserve Decision and Powell’s Remarks

As broadly anticipated by financial markets, the Federal Reserve left its benchmark interest rate unchanged at the conclusion of Wednesday’s meeting. The Federal Open Market Committee (FOMC) voted 9–2 in favor of holding rates steady, maintaining the current target range of 4.25%–4.50%, in place since the beginning of the year. Dissenting votes came from Michelle Bowman and Christopher Waller, who advocated for a resumption of rate cuts.

The statement released after the meeting introduced two notable changes from the June communiqué regarding the Committee’s outlook on U.S. economic conditions. First, while the June statement reflected optimism, noting the economy was “growing at a steady pace,” the July iteration conveyed a more cautious stance, acknowledging heightened uncertainty. The updated wording suggested lingering concerns, reversing the earlier view that uncertainty was fading.

Second, market participants had priced in a potential rate cut by September, contingent on incoming data. However, the June statement had subtly pointed to the possibility of two cuts within the year. The divergence in expectations, combined with two dissenting votes—the first such instance since late 1993—highlighted emerging differences within the FOMC.

Chair Jerome Powell dismissed the likelihood of near-term rate reductions, citing persistent inflation risks tied to tariff impacts. He emphasized continued labor market strength and emerging signs of tariff-related consumer price pressures, reinforcing the case for maintaining a restrictive monetary policy stance.

Economic Data Overview

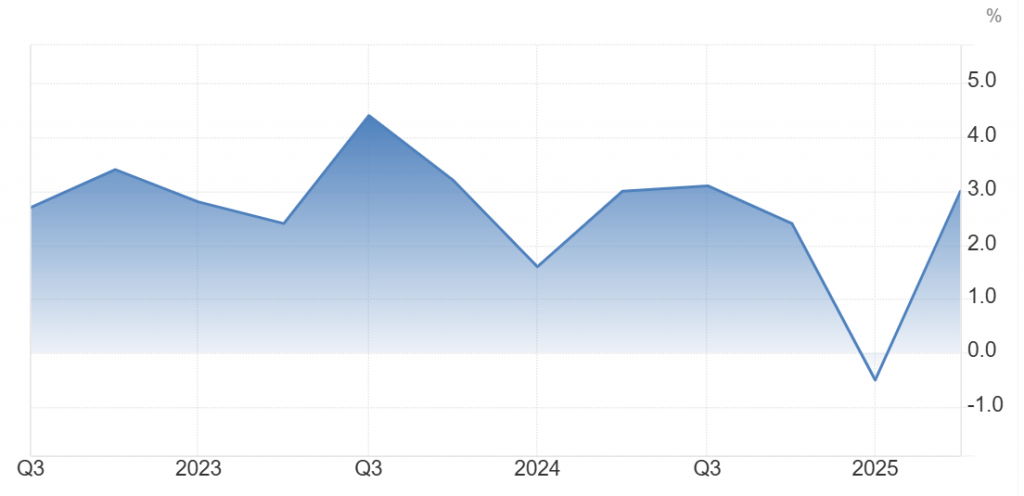

U.S. GDP rose to 3.00% in Q2 of this year, compared to -0.5% in the same period last year—well above the market forecast of 2.4%.

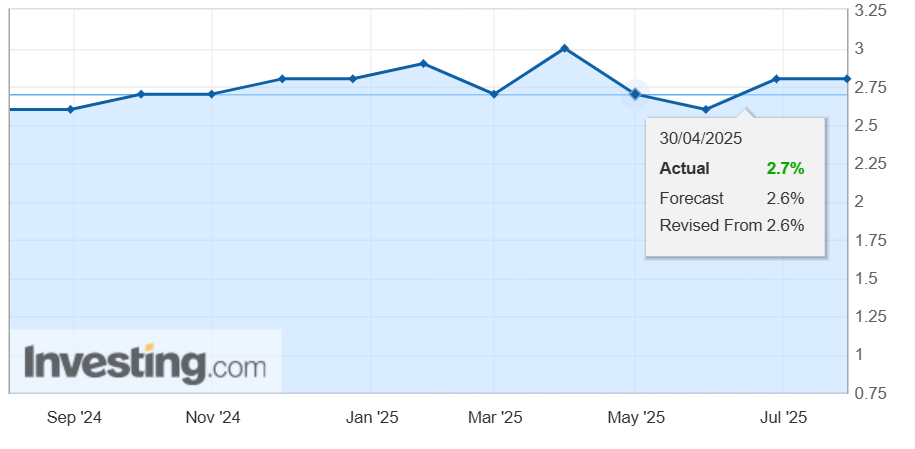

The Personal Consumption Expenditures (PCE) Index, the Federal Reserve’s preferred inflation gauge, increased to 2.6% in June from 2.4% a year earlier, matching market expectations. The core PCE index, which excludes food and energy, remained unchanged at 2.8%, exceeding forecasts of 2.8%.

Personal spending climbed 0.3% in June, up from 0.0% in May and above the expected 0.2% increase.

However, U.S. employment growth disappointed. The Non-Farm Payrolls (NFP) report showed an increase of 73,000 jobs in July, down from a downwardly revised 14,000 previously, and below the market’s forecast of 110,000.

Average hourly earnings saw a modest monthly rise of 0.3%, up from 0.2%, in line with expectations. The annual rate reached 3.9% in July, slightly higher than the previous 3.8%, and also in line with market consensus.

The U.S. unemployment rate edged up to 4.2% in July, from 4.1% the previous month, meeting market expectations.

Trump tariffs deadline

Following the deadline set by U.S. President Donald Trump for dozens of countries to submit proposals for trade agreements with the United States—August 1—not all nations complied with Washington’s request, and will therefore be subject to high tariffs beginning this month.

Trump announced the implementation of elevated tariffs—previously suspended for over 90 days—on 69 U.S. trading partners, ranging from 10% to 41%. These rates will be applied within seven days of the announcement.

This follows the expiration of the grace period the president had granted those countries to submit proposals for trade agreements with Washington.

The Trump administration imposed a 35% tariff on Canada, 39% on imports from Switzerland, and 25% on imports from India.

Tariffs were also imposed on several Arab countries: 15% on Jordan, 25% on Tunisia, 30% on Algeria and Libya, 35% on Iraq, and 41% on Syria.

The U.S. president stated he would later decide whether to extend the trade truce with China or allow it to expire, triggering the application of major U.S. tariffs on Chinese goods once the truce ends on August 12.

Trump had announced the concept of “reciprocal tariffs” on April 2, applying unprecedented duties on exports to the U.S. from a wide range of countries.

However, on April 8, he suspended the measure for 90 days, with the freeze set to expire on July 9, later extended to August 1.

Many observers viewed the deadline as a final opportunity for trade partners to submit offers and negotiate terms—failing which the tariffs would be reinstated.

The extension was seen as an indication that the U.S. administration was using trade negotiations as leverage to gain economic advantages.

US dollar and gold

The U.S. dollar posted weekly gains, supported by early-week positive developments, including a trade agreement between the United States and the European Union.

Stronger GDP data for Q2 also contributed to dollar strength, alongside an uptick in the Personal Consumption Expenditures (PCE) Index—the Federal Reserve’s most reliable inflation gauge.

Market volatility, driven by several key catalysts, supported gold prices, which ended the week up 0.8%.

Gold rose to $3,362 per ounce, compared to the prior weekly close of $3,336, having traded between a low of $3,268 and a high of $3,363 during the week.

European Currencies

The euro and the British pound posted weekly losses, pressured by the strength of the U.S. dollar.

The decline in the euro occurred despite several supportive factors, including improved data reflecting progress in the Eurozone’s economic performance.

The single currency was also negatively affected by the trade agreement between the United States and the European Union.

This impact was driven by market speculation suggesting the agreement favors U.S. interests at the expense of the European Union.

Additionally, ongoing trade negotiations between the two sides continue to introduce uncertainty, leaving room for potential developments that could hinder the agreement’s progress.

Global Shares

Global equities posted weekly losses, weighed down by a range of negative factors across financial markets. Key drivers included weak U.S. employment data, elevated inflation readings, and a decline in consumer confidence.

Major U.S. indices recorded notable declines: the Dow Jones Industrial Average fell 1.3%, the S&P 500 lost 1.6%, and the tech-heavy Nasdaq dropped 2.3%.

European stocks also ended the week lower, with the Stoxx Europe 600 index down 1.9%. In Asia, the Dow Asia index declined by approximately 1.7%, while Japan’s Nikkei registered a weekly loss exceeding 2.0%.

Oil Posts Weekly Gains

Oil recorded notable weekly gains, driven by renewed threats of U.S. sanctions targeting Iranian and Russian crude exports. President Donald Trump warned of additional measures against Russia unless a peace agreement with Kyiv is reached within fifty days. While initial market reaction was muted, subsequent actions by the administration revived concerns over potential supply disruptions.

Trump also threatened sanctions against India for continuing to import Russian oil. Meanwhile, the U.S. administration launched a broad campaign aimed at tightening restrictions on domestic oil supply flows. A decline of five active U.S. drilling rigs at week’s end added further support to global price momentum.

Despite new tariff decisions that could have pressured prices, oil markets largely overlooked them—likely due to their late release during the final trading hours of the week. Toward the week’s close, downside pressure emerged as OPEC+—including Russia—gave preliminary approval for a production increase of 547,000 barrels per day starting in September.

Bitcoin Whales

Bitcoin recorded weekly losses, driven by profit-taking following substantial purchases of the world’s most widely traded cryptocurrency. Whale investment flows surged on Binance, with inflows reaching $1.2 billion in a single day last week.

This spike in whale activity led to a sharp rise in Bitcoin prices, which subsequently triggered broad profit-taking amid growing market anxiety. Historical patterns support this behavior, as Bitcoin often retreats after reaching record highs before resuming its upward trajectory.

While short-term profit-taking was primarily observed among retail investors, buying momentum remained strong throughout the week.

The Week Ahead

This week, several corporate earnings reports are expected to influence market sentiment, including releases from McDonald’s, Pfizer, Disney, and Uber.

Key U.S. data will also be published, covering trade balance, consumer credit, and service sector confidence.

Additionally, Federal Reserve officials—including Mary Daly and Christopher Waller—are scheduled to deliver remarks that may offer further insight into monetary policy direction.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations