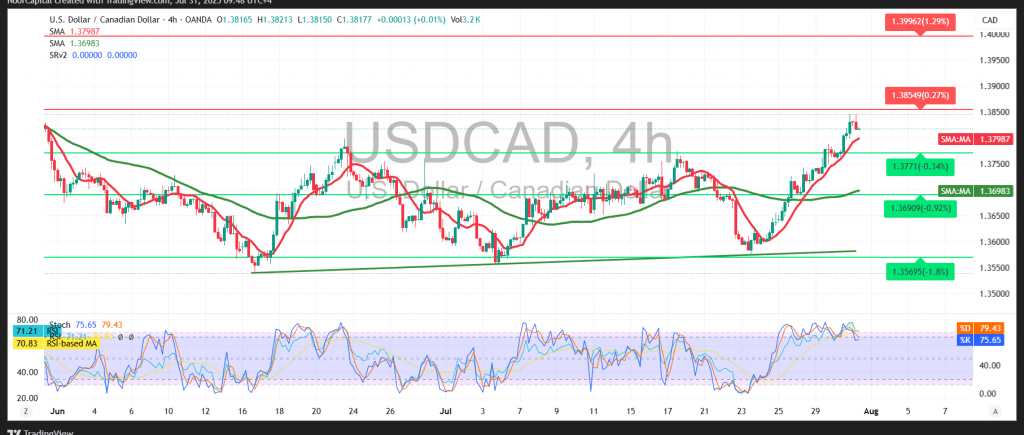

The USD/CAD pair continued to follow the bullish outlook highlighted in our previous report, successfully reaching the official target of 1.3840 and recording a session high of 1.3845.

Technical Outlook:

The pair maintains a strong upward trajectory, supported by continued price stability above key Simple Moving Averages (SMAs), which act as dynamic support levels. This bullish sentiment is further reinforced by the Relative Strength Index (RSI), which continues to trend higher, signaling sustained positive momentum.

Probable Scenario:

As long as the pair remains stable above the 1.3770 support level, the bullish trend is expected to persist. A confirmed breakout above the 1.3860 resistance level would likely act as a fresh catalyst, potentially driving the pair toward 1.3900, followed by an extended move toward 1.3945.

Alternative Scenario:

A decisive break below the 1.3765 support level could trigger a short-term corrective pullback, with the next key support seen at 1.3720.

Key Risk Events – Volatility Expected:

Traders should brace for potential market swings today as the U.S. is set to release high-impact economic data, including:

- Weekly Unemployment Claims

- Core Personal Consumption Expenditures (Core PCE)

- Employment Cost Index (Quarterly)

These releases are likely to influence USD volatility and, by extension, USD/CAD price action.

Warning:

Risk levels remain elevated amid ongoing geopolitical and trade-related tensions. All scenarios should be considered, and appropriate risk management is strongly advised.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations