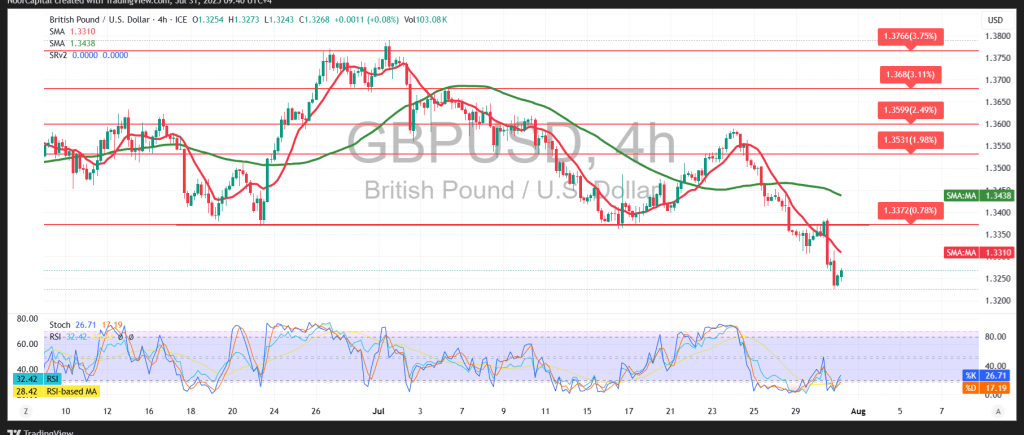

The British pound extended its decline against the U.S. dollar, weighed down by persistent dollar strength. The move aligns with our previous bearish forecast, with the pair reaching the anticipated target at 1.3250 and recording a session low of 1.3232.

Technical Outlook:

Intraday price action reflects a modest rebound attempt, supported by temporary consolidation above the 1.3230 support level. The Relative Strength Index (RSI) is beginning to show early positive signals after entering oversold territory, suggesting the potential for limited corrective movement.

However, the broader bearish pressure remains intact, with the price continuing to trade below the 50-period Simple Moving Average (SMA)—a key dynamic resistance—while the overall trend remains downward.

Likely Scenario:

As long as the pair remains below the key resistance at 1.3350, the bearish outlook prevails. A confirmed break below 1.3230 could trigger a further move to the downside, with targets at 1.3205 and 1.3160, respectively.

Alternative Scenario:

Should the price break above the 1.3360 resistance level and sustain trading above it, a recovery wave may begin, initially targeting 1.3405, followed by 1.3445.

Key Risk Events – Volatility Expected:

Today’s trading session may see increased volatility due to the release of several high-impact U.S. economic indicators, including:

- Weekly Unemployment Claims

- Core Personal Consumption Expenditures (Core PCE)

- Employment Cost Index (Quarterly)

These releases could significantly affect dollar sentiment and GBP/USD volatility.

Warning:

Risk levels remain elevated amid ongoing trade and geopolitical tensions. Traders should prepare for sharp intraday price movements and manage exposure accordingly.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations