U.S. crude oil futures surged during the previous trading session, aligning with the bullish expectations outlined in our prior report. The price successfully reached the official target at $70.40, marking a session high of $70.48 per barrel.

Technical Outlook:

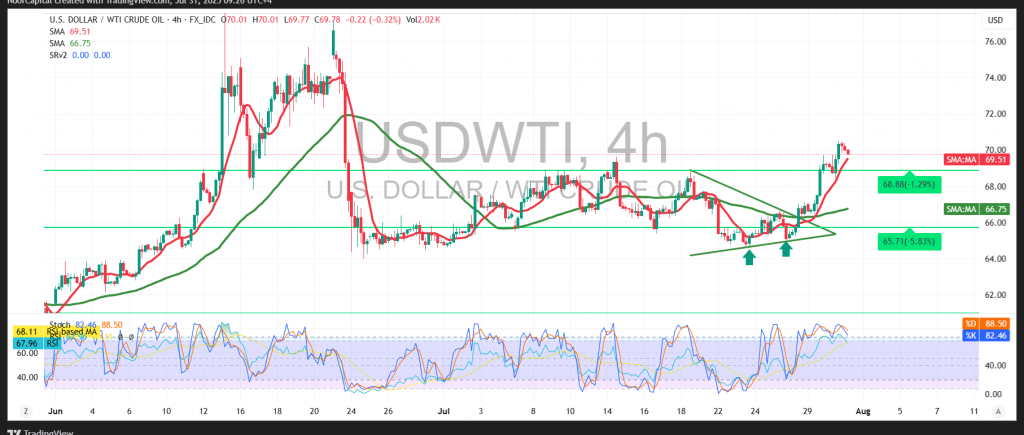

Following the recent rally, intraday movements are showing modest pullbacks, likely due to profit-taking. A closer look at the chart indicates that the Relative Strength Index (RSI) is attempting to exit overbought territory, potentially setting the stage for renewed upward momentum. Meanwhile, price action remains supported by the 50-period Simple Moving Average (SMA), which continues to serve as dynamic support.

Probable Scenario:

As long as the price remains stable above the key support level at $68.70, the bullish outlook is expected to prevail. A confirmed breakout above the $70.40 resistance would likely lead to further gains, targeting $70.70 initially, followed by an extension toward the next resistance at $71.70.

Alternative Scenario:

A break and sustained close below the $68.70 level on the hourly timeframe could shift momentum to the downside, increasing selling pressure and setting up a potential retest of the critical support zone around $67.60.

Key Risk Events – Volatility Watch:

Traders should be alert to possible market swings today, as the U.S. is scheduled to release several high-impact economic indicators, including:

- Weekly Unemployment Claims

- Core Personal Consumption Expenditures (Core PCE)

- Employment Cost Index (Quarterly)

These reports may significantly impact crude oil prices and broader market sentiment.

Warning:

Given ongoing geopolitical and trade-related uncertainties, risk levels remain elevated. All scenarios should be considered, and traders are advised to manage positions cautiously.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations