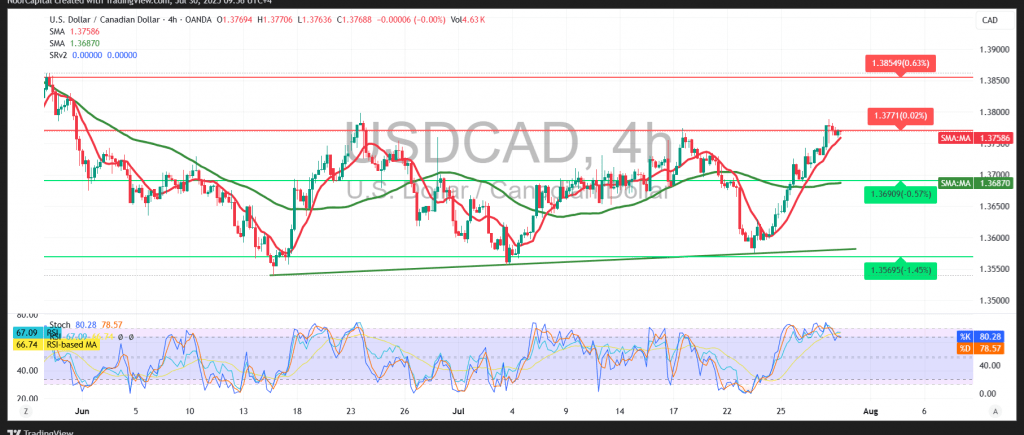

The USD/CAD pair confirmed the bullish outlook outlined in our previous report, reaching the initial target at 1.3780 and registering a session high of 1.3788.

Technical Outlook:

Intraday price action continues to reflect a strong bullish trend, supported by sustained stability above the key Simple Moving Averages (SMAs), which serve as dynamic support levels. Additionally, the Relative Strength Index (RSI) is attempting to gain further upward momentum, signaling the potential for continued price appreciation.

Probable Scenario:

As long as the pair holds above the support levels at 1.3720—and more critically, 1.3700—the bullish bias remains intact. A confirmed breakout above the 1.3780 level would serve as a catalyst for further gains, with upside targets at 1.3800 and 1.3840, respectively.

Alternative Scenario:

Should the price break and close below the 1.3700 support level, the bullish momentum may weaken, exposing the pair to a potential decline toward the next support at 1.3670.

High-Impact Events – Volatility Expected:

Today, markets will be highly sensitive to major economic releases from both the United States and Canada, including:

- U.S. Non-Farm Payrolls (ADP)

- U.S. Quarterly GDP data

- Federal Reserve interest rate decision

- FOMC statement and Chair Powell’s press conference

- Bank of Canada interest rate decision

These events are likely to trigger heightened volatility in the USD/CAD pair.

Warning:

With elevated geopolitical and trade tensions, the risk environment remains high. Traders should be prepared for sharp market movements and plan risk management accordingly.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations