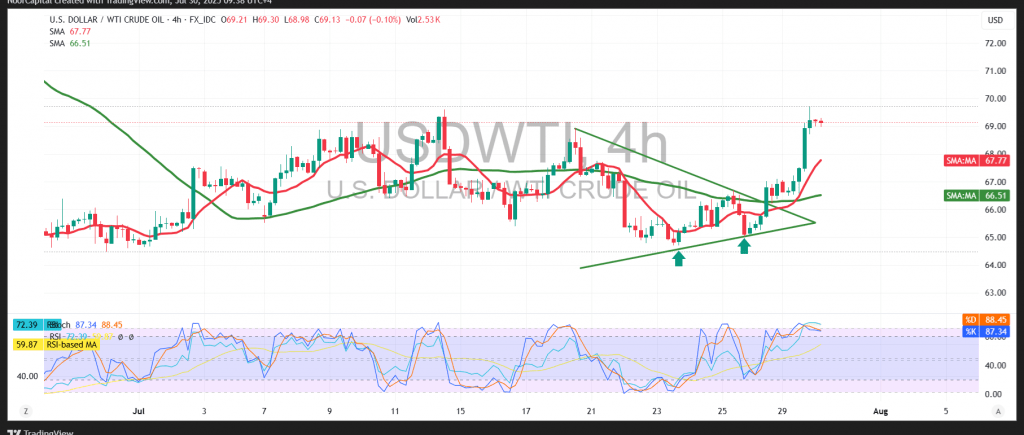

WTI crude oil prices recorded a notable surge during the previous session, validating our previously neutral stance that highlighted a potential breakout above the minor downtrend line. The expected targets at $67.40 and $68.20 were both reached, with crude ultimately hitting a high of $69.72 per barrel.

Technical Outlook:

US crude continues to trade positively above the key Simple Moving Averages (SMAs), providing dynamic support and reinforcing the bullish momentum. Additionally, technical indicators are turning increasingly supportive, particularly the Relative Strength Index (RSI), which is attempting to exit overbought territory—suggesting room for further upside.

Probable Scenario:

As long as the price holds above the former resistance-turned-support level at $68.40, the outlook remains bullish. A confirmed breakout above the recent high of $69.70, followed by sustained trading above it, would likely open the door for further gains toward the next target at $70.40 per barrel.

Alternative Scenario:

Should the price break below the $68.40 level and close beneath it on the hourly chart, this could trigger renewed selling pressure, with the next support level to watch at $67.20.

High-Impact Events – Caution Advised:

Today, traders should brace for increased volatility as the market awaits a series of major U.S. economic releases, including:

- Non-Farm Payrolls (ADP)

- Quarterly GDP data

- Interest Rate Decision

- FOMC Statement

- Press Conference by Federal Reserve Chair Jerome Powell

Warning:

Amid ongoing trade and geopolitical tensions, risk remains elevated and sharp price movements in either direction are possible.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations