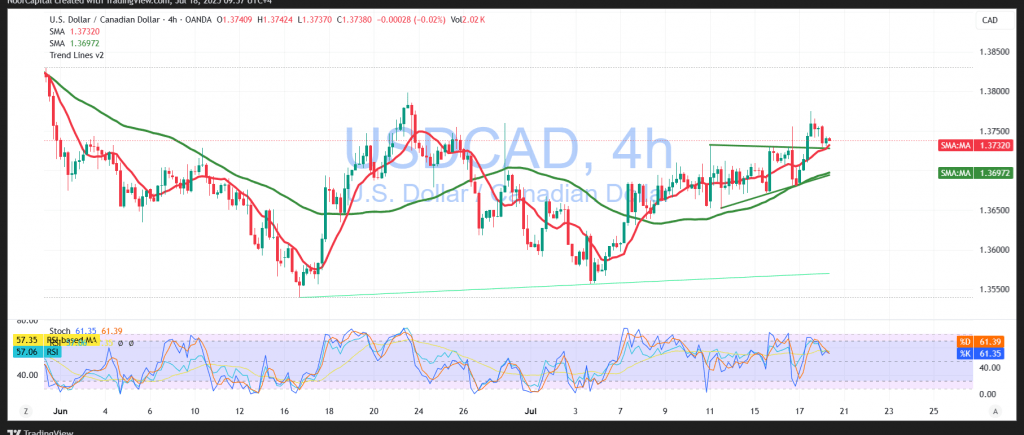

The Canadian dollar continued its upward trajectory, achieving the expected positive targets outlined in the previous technical report. The pair reached the 1.3770 target and extended to a new high of 1.3774.

Technical Outlook – 4-Hour Timeframe:

Price action reflects ongoing bullish momentum, supported by the pair’s stability above the key support level at 1.3680 and continued backing from the 50-period Simple Moving Average (SMA). These factors favor the likelihood of a gradual continuation of the uptrend in the short term.

However, early negative signals on the Relative Strength Index (RSI) are beginning to appear, suggesting that momentum could slow temporarily and a minor correction may occur before resuming the uptrend.

Probable Scenario – Bullish Bias:

As long as the price holds above 1.3680, the bullish outlook remains intact, with the next upside targets at:

- 1.3780 (initial resistance)

- 1.3820 (next key resistance / official target)

Alternative Scenario – Corrective Pullback:

A break below 1.3680 would weaken the bullish structure and may trigger a downward correction, targeting:

- 1.3645 as the first support

- 1.3610 as a deeper support level

Caution:

The risk level remains elevated amid ongoing geopolitical and trade tensions. All scenarios are possible, and effective risk management is essential.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations