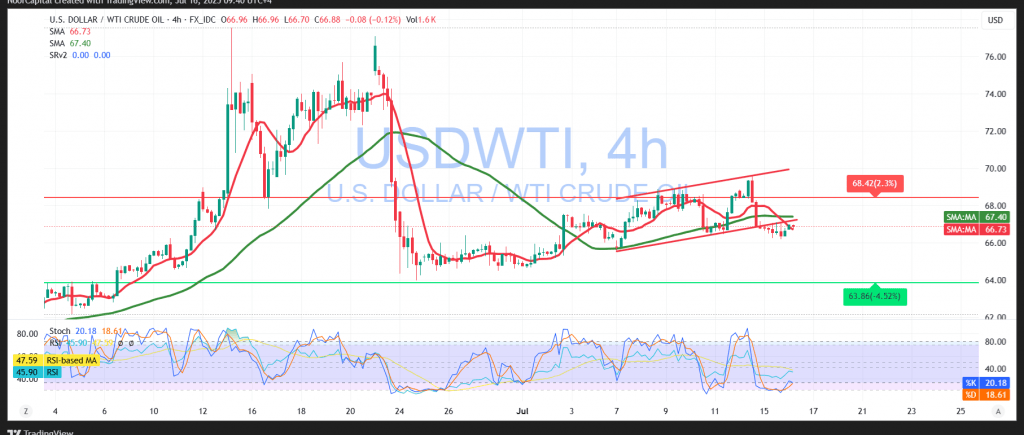

U.S. crude oil futures extended their bearish momentum in the previous trading session, falling to a low of $66.25 per barrel.

Technical Outlook – 4-Hour Timeframe:

Intraday movements are showing signs of mild recovery attempts from oversold conditions. The Relative Strength Index (RSI) is attempting to generate early positive signals, hinting at a potential short-term bounce. However, the price remains below the 50-period Simple Moving Average (SMA), which continues to act as dynamic resistance, reinforcing the dominant downward trend.

Probable Scenario – Bearish Bias:

As long as the price remains below the $67.20 resistance level—and more importantly, $67.40—the bearish outlook is likely to persist. The next support target is $66.40, and a confirmed break below this level would strengthen the downside momentum, opening the path toward $65.85 as the subsequent support zone.

Alternative Scenario – Temporary Recovery:

Should the price consolidate and break above $67.40, it could signal a short-term shift in sentiment. In this case, we may see a recovery attempt targeting $67.60, with $68.10 as the next upside level.

Market Catalyst:

Traders should be cautious ahead of today’s release of U.S. Core Producer Price Index (PPI) data (monthly and annual), which is expected to introduce high volatility in oil markets and dollar-denominated assets.

Caution:

Risk remains elevated due to ongoing geopolitical and trade-related tensions. All scenarios are possible, and strict risk management is advised.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations