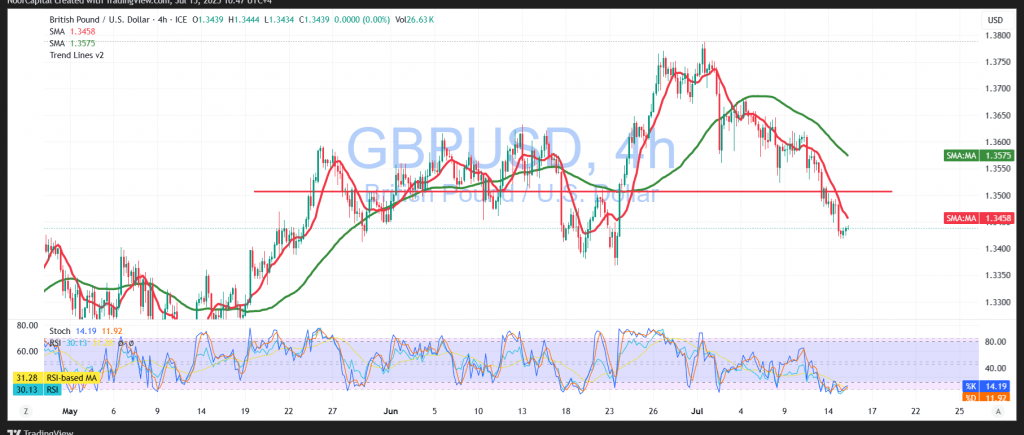

The British pound extended its decline against the U.S. dollar during the previous session, reaching a new low at 1.3422, in line with prior technical expectations.

Technical Outlook – 4-Hour Timeframe:

Bearish pressure remains dominant, as simple moving averages continue to act as dynamic resistance levels, limiting any upward correction. The 50-period moving average intersects near the key resistance level at 1.3490, reinforcing its technical significance. However, the Relative Strength Index (RSI) is showing early positive crossover signals from oversold territory, indicating the potential for a short-term rebound.

Probable Scenario – Bearish Bias:

As long as the pair remains below 1.3490, the downward trend is likely to continue. A confirmed break below 1.3415 would strengthen the bearish outlook, opening the way for declines toward 1.3370, followed by 1.3330.

Alternative Scenario – Recovery Attempt:

If the pair breaks above 1.3490 and holds, this could signal a short-term recovery, with upside potential toward 1.3540.

Market Catalyst:

Traders should prepare for heightened volatility today, as the U.S. is set to release high-impact inflation data, including monthly and annual Core CPI figures.

Caution:

Risk remains high amid ongoing geopolitical and trade-related uncertainties. All market scenarios are possible, and prudent risk management is essential.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations