U.S. crude oil futures posted strong gains in the previous session, reaching an intraday high of $68.61 per barrel.

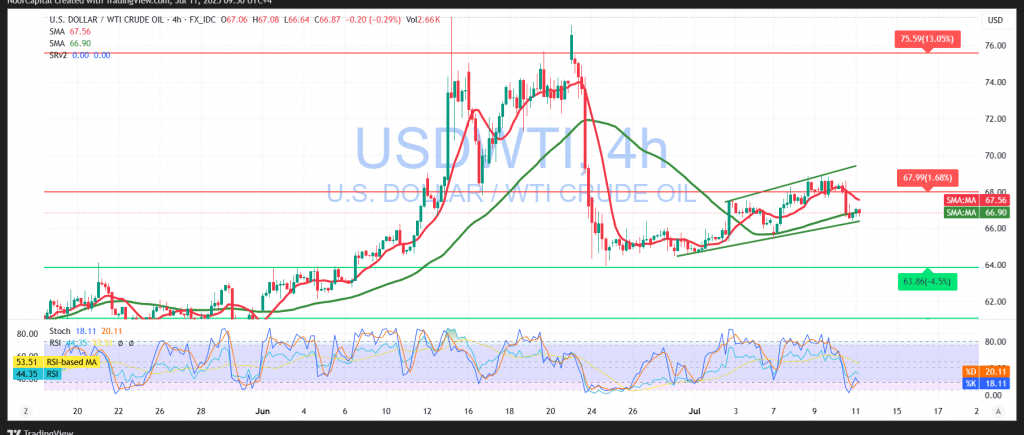

Technical Outlook – 4-Hour Timeframe:

Price action remains supported by an ascending trend line, with the simple moving averages acting as dynamic support—indicating sustained bullish momentum. Notably, a positive divergence between price and the Relative Strength Index (RSI) further strengthens the bullish outlook in the near term.

Probable Scenario (Bullish Bias):

As long as daily trading holds above the key psychological support at $66.00, the bullish scenario is favored. Initial resistance is seen at $67.75. A confirmed breakout above this level could accelerate gains toward the next resistance at $68.15.

Alternative Scenario:

Failure to hold above the $68.00 mark could trigger renewed selling pressure, with downside targets at $65.20.

Caution:

The risk environment remains elevated due to ongoing geopolitical and trade tensions. Volatility may increase, and all scenarios remain possible. Traders are advised to apply appropriate risk management strategies.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations