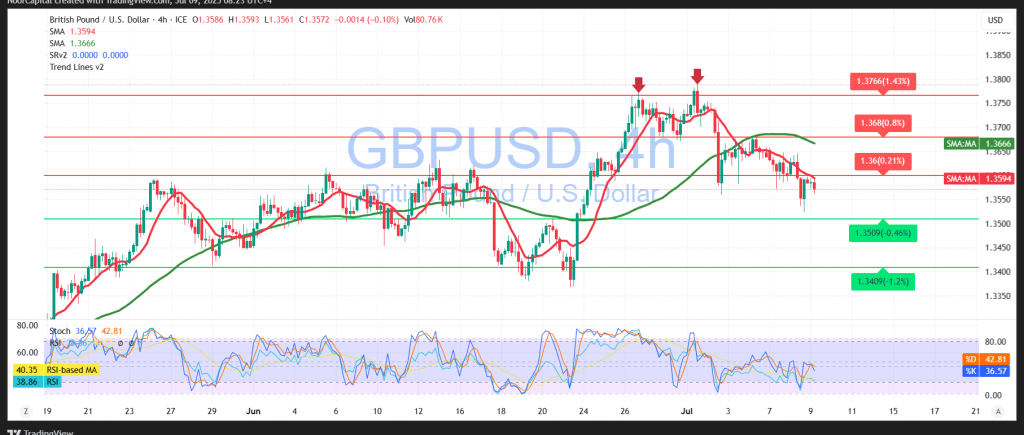

The British pound extended its decline against the US dollar during yesterday’s session, pressured by the strengthening greenback — in line with previous technical expectations. The pair reached the projected target at 1.3540, recording a session low of 1.3525.

Technical Outlook – 4-Hour Timeframe:

Bearish momentum remains dominant, with the simple moving averages continuing to act as dynamic resistance levels. The 50-period SMA aligns closely with the 1.3630 resistance area, reinforcing its technical significance. Meanwhile, the Relative Strength Index (RSI) remains in negative territory, supporting expectations of continued downward movement in the short term.

Likely Scenario (Bearish Bias):

As long as the pair trades below 1.3640, further declines are expected, initially targeting 1.3515. A confirmed break below this level would likely strengthen bearish momentum and open the path toward 1.3460.

However, if the pair stabilizes above 1.3640 and regains bullish momentum, we may witness a corrective rebound aiming for 1.3705, with the potential to extend toward 1.3755.

Market Catalyst:

Traders should remain cautious ahead of the release of the U.S. Federal Reserve meeting minutes later today. This high-impact data could trigger sharp price fluctuations across major currency pairs.

Caution:

Risk remains elevated due to ongoing geopolitical and trade tensions. All scenarios remain possible, and appropriate risk management is advised.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations