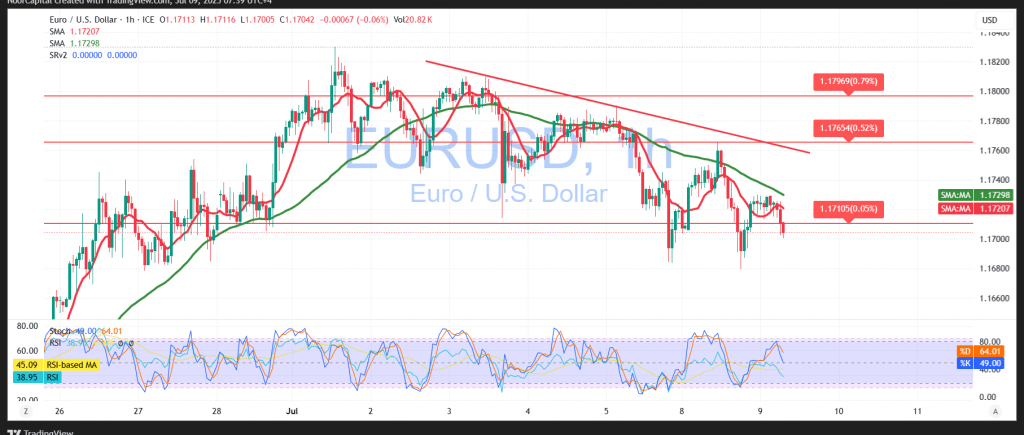

The EUR/USD pair has successfully activated the expected bearish scenario outlined in the previous technical report, reaching the first corrective target at 1.1690 and recording a session low of 1.1682.

Technical Outlook – 4-Hour Timeframe:

The technical picture continues to show bearish pressure on the pair. The 50-period Simple Moving Average (SMA) remains a dynamic resistance level, capping any upward attempts. This is accompanied by gradual signs of weakness appearing on the Relative Strength Index (RSI), which further supports the likelihood of continued downside movement.

Expected Scenario:

As long as the price remains below 1.1750—and more significantly below the key resistance level at 1.1800—we expect the corrective decline to persist. A confirmed break below 1.1670 would likely open the door to further losses, targeting 1.1635 as the next support level, followed by 1.1580.

However, a break above 1.1800 would serve as a potential bullish reversal signal, possibly paving the way for gains toward 1.1840 and then 1.1900.

Market Catalyst:

Traders should remain cautious as the release of the U.S. Federal Reserve meeting minutes is scheduled for today. This is a high-impact event that could trigger increased market volatility.

Caution:

Risk remains elevated amid ongoing global trade tensions. All scenarios remain on the table, and appropriate risk management is strongly advised.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations