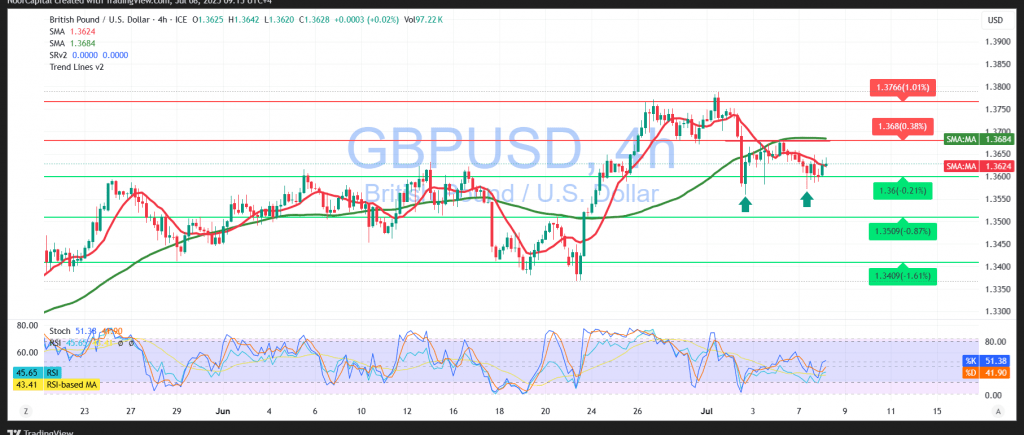

Timeframe: 4-Hour Chart

The British pound continued to post gains against the U.S. dollar in the previous session, reaching a high of 1.3658, supported by ongoing bullish momentum. However, signs of consolidation are beginning to emerge.

Technical Indicators

- The 50-day simple moving average is aligning with the 1.3675 resistance level, reinforcing it as a solid technical ceiling.

- The Relative Strength Index (RSI) is showing early signs of negative divergence, which may indicate weakening upward momentum.

Bearish Scenario

A confirmed break below 1.3600 could initiate a downward move, potentially targeting:

- 1.3585 as the first support

- 1.3540 as the second support level

Bullish Contingency

Should the price maintain support above 1.3670 and regain bullish momentum, a short-term recovery may develop, aiming for:

- 1.3705 as the initial upside target

- 1.3755 if bullish pressure intensifies

Conclusion

Short-term direction remains uncertain. A break below 1.3600 supports a bearish view, while stability above 1.3670 revives the bullish case.

Warning

Market conditions remain volatile amid global trade and geopolitical tensions. All scenarios are possible. Risk management is essential.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations