The GBP/USD pair came close to achieving the official target outlined in our previous report at 1.3810, reaching a session high of 1.3790.

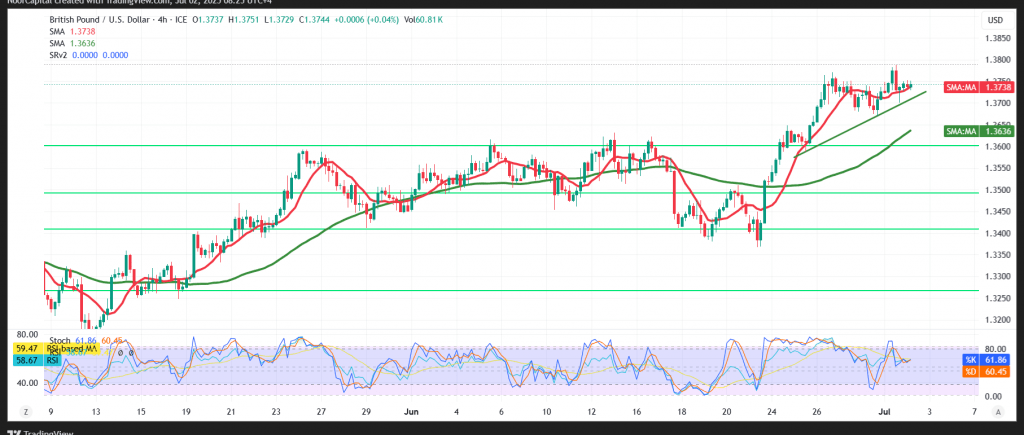

Technical Outlook – 4-hour Chart:

The pair successfully closed above the key psychological level of 1.3700, supported by sustained dynamic momentum from the simple moving averages, which reinforces the broader daily uptrend.

Probable Scenario – Bullish Bias:

The outlook remains bullish, with immediate resistance seen at 1.3790. A confirmed break above this level could act as a catalyst to extend gains toward:

- 1.3835, followed by

- 1.3875 as the next key resistance zone.

Cautionary Note:

A return to stable trading below 1.3705 would delay further upside movement and subject the pair to short-term bearish pressure, potentially triggering a retest of 1.3660.

Warning:

- High-impact U.S. economic data, specifically the Non-Farm Payrolls (NFP), is due today and may trigger significant market volatility.

- Ongoing trade and geopolitical tensions continue to pose elevated market risks, making all outcomes possible.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations