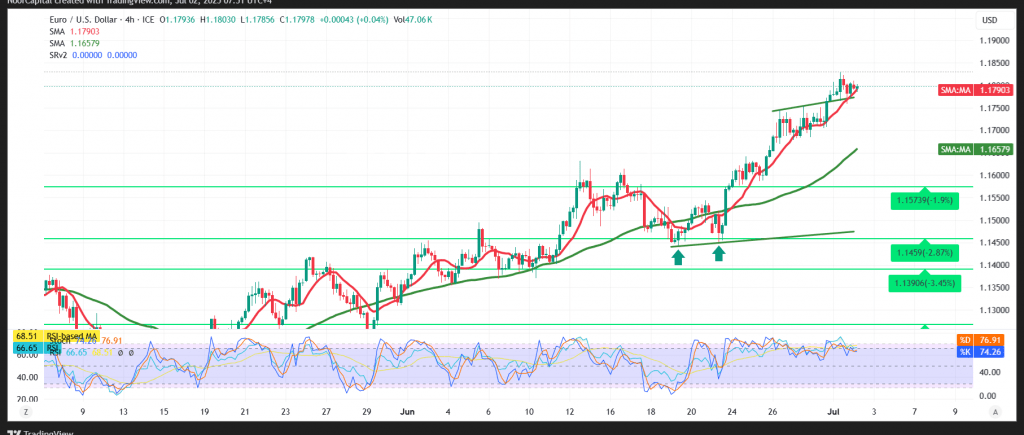

The EUR/USD pair continues to follow a positive trajectory, in line with prior expectations, reaching the 1.1800 target and recording a session high of 1.1830.

Technical Outlook (4-hour timeframe):

Despite some mild profit-taking, technical indicators remain aligned with a continuation of the uptrend:

- The pair is trading consistently above the 50-day simple moving average, reinforcing bullish sentiment.

- The Relative Strength Index (RSI) has cleared overbought conditions and is regaining upward momentum.

As long as daily trading stays above 1.1760 and, more importantly, 1.1725, the bullish scenario remains active. A confirmed break of the 1.1840 resistance would reinforce the uptrend, opening the path toward 1.1870 and 1.1900.

Should the pair dip below 1.1725, it would not invalidate the uptrend entirely but could delay further gains, possibly leading to a retest of 1.1690 before another rally attempt.

Warning: The upcoming U.S. non-farm payrolls data is expected to cause high market volatility.

Warning: Risk remains elevated amid trade and geopolitical tensions; all outcomes remain on the table.

Warning: Trading CFDs carries risk. This analysis is not a recommendation to buy or sell, but an illustrative interpretation of chart movements.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations