US crude oil futures experienced narrow-range trading, showing only a slight upward inclination and reaching a high of $66 per barrel.

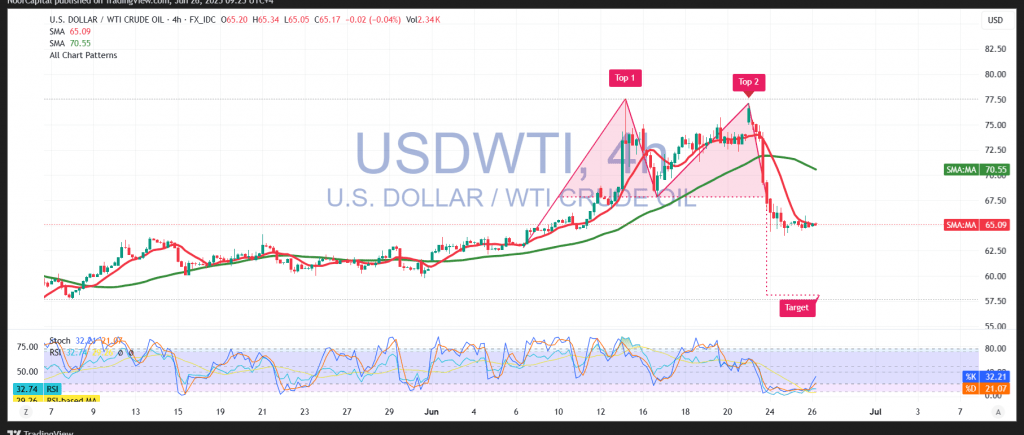

From a technical perspective, oil prices are attempting to recover some of the recent losses during intraday movement, with current efforts focused on stabilizing above the $65.00 level. However, the 240-minute chart reveals that simple moving averages are acting as dynamic resistance, hindering further gains. Additionally, the chart reflects a bearish technical structure that could continue to apply downward pressure on prices.

Given this context, a bearish outlook is preferred unless a confirmed break above $66.00 occurs. A decisive breach of the 64.50 support level could trigger further selling pressure, paving the way for a move toward 63.80, with an extended target at 63.00.

On the flip side, should prices successfully break above the psychological resistance of 66.00, this could temporarily lift the market, with potential gains toward 66.65 and possibly 67.30.

Warning: Today’s release of key U.S. economic data, including the final quarterly GDP reading and weekly jobless claims, may trigger high market volatility.

Warning: Risk remains elevated due to persistent trade and geopolitical uncertainties, and multiple outcomes are possible.

Caution: In the context of ongoing global trade tensions and broader economic uncertainty, volatility may remain elevated. Manage risk accordingly, as all outcomes remain on the table.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations