Gold prices took a sharp downturn during the previous session, hitting a low of $3,295 per ounce.

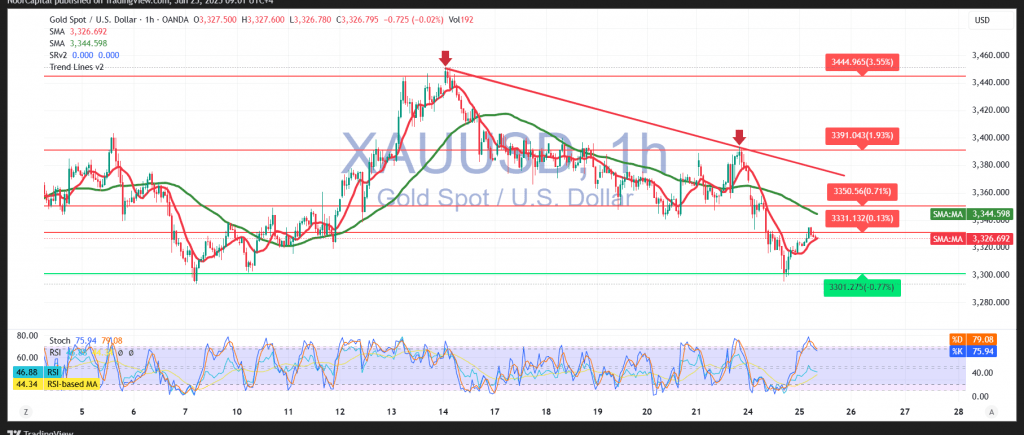

From a technical standpoint, the market is attempting a modest rebound following oversold conditions. However, the 60-minute chart shows the price is still contained within a downward corrective wave, bounded by a descending trend line that persists over the short term.

In this context, the dominant bias remains bearish. A confirmed break below $3,295 would likely signal further declines, targeting $3,260, with a secondary downside objective near $3,226.

It’s important to note that this bearish scenario hinges on the price remaining under resistance at $3,362. A break above that level would invalidate the downside case and could drive gold prices higher in the near term, with potential gains toward $3,396 and $3,410.

Warning: Markets are on edge ahead of today’s release of Federal Reserve Chairman Jerome Powell’s testimony, a high-impact event that may fuel sharp volatility in gold and other asset classes.

Risk Alert: Ongoing global trade and geopolitical uncertainties continue to keep risk elevated, and traders should be prepared for a wide range of outcomes.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations