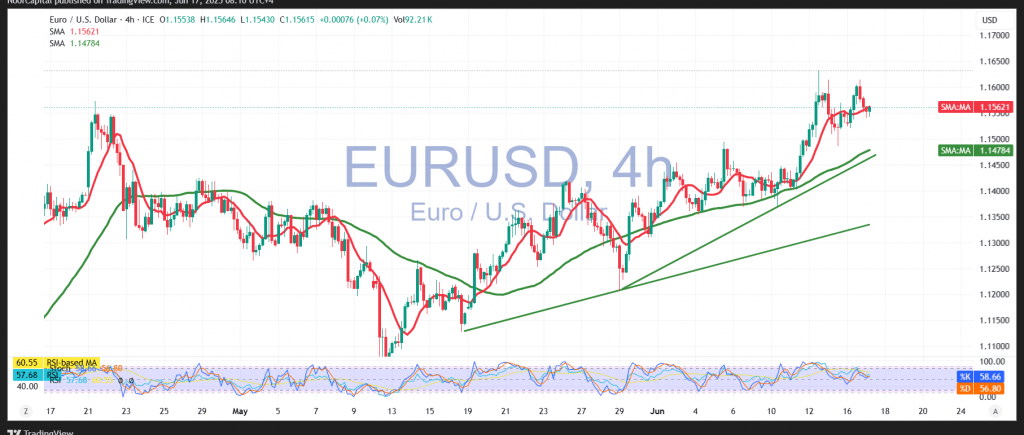

The EUR/USD pair is currently undergoing a bearish correction following several sessions of sustained gains, with the euro unable to maintain a foothold above the key psychological resistance level of 1.1600. As of the latest data, the pair is trading near 1.1555.

From a technical perspective, the 4-hour chart indicates that the pair is starting to exit overbought territory, signaling a potential slowdown in bullish momentum. The Relative Strength Index (RSI) is showing early signs of negativity, which supports the short-term bearish outlook. However, the simple moving averages continue to provide underlying support and remain aligned with the prevailing ascending trend line, keeping the broader uptrend intact.

Given these mixed signals, the outlook remains cautiously bullish as long as the pair sustains daily closes above the 1.1520 support level. A confirmed breakout above 1.1600 is essential to reinstate upward momentum, paving the way for a move toward 1.1670, followed by 1.1720.

Should the pair fall below 1.1520, it would delay the bullish scenario, potentially triggering a deeper pullback toward 1.1470 and 1.1420 before another attempt to rise.

Warning: High-impact U.S. retail sales data is scheduled for release today, which could introduce significant market volatility.

Warning: Risk remains elevated amid ongoing trade and geopolitical tensions, and all scenarios are possible.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations