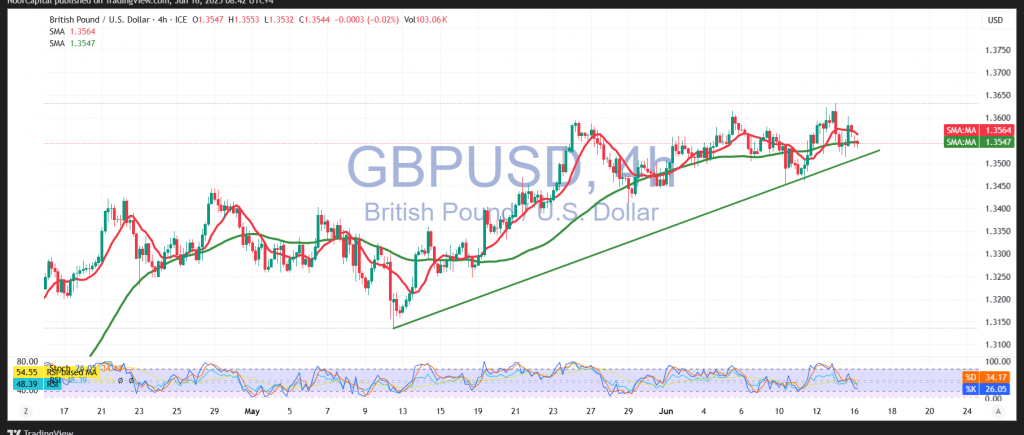

The GBP/USD pair successfully reached the initial target highlighted in the previous technical report at 1.3635, recording a high of 1.3632.

From a technical analysis perspective, the 4-hour chart reveals a slight pullback as the pair attempts to clear overbought conditions. However, the 14-day momentum indicator is beginning to show renewed positive signals, while the pair remains stable above the simple moving averages, which continue to provide strong dynamic support.

Bullish momentum remains the dominant bias for today, with the pair attempting to breach the key resistance level at 1.3600. A confirmed breakout above this level would pave the way for an advance toward 1.3680 as the first target, followed by 1.3720 as an initial official stop.

Reminder: A sustained move back below 1.3500 could disrupt the upward trajectory and expose the pair to renewed downside pressure, with potential targets at 1.3450.

Warning: The risk level remains elevated amid ongoing trade and geopolitical tensions. All scenarios are possible, and traders should remain cautious.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations