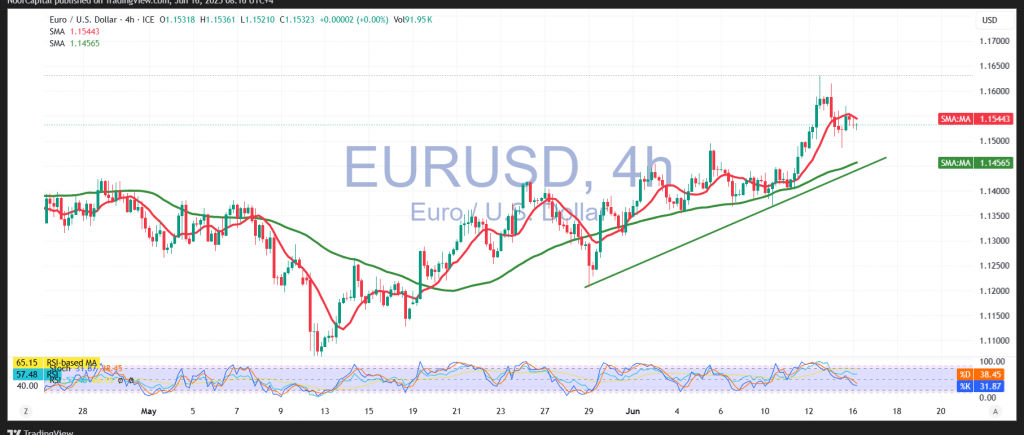

The euro continued its strong performance against the US dollar, advancing in line with the previously expected bullish scenario and reaching the official target of 1.1600, with a session high of 1.1614.

From a technical standpoint, the upward trend remains intact and favored. This outlook is supported by the euro’s sustained trading above key simple moving averages, which continue to serve as dynamic support levels. Additionally, the pair is maintaining its trajectory along the ascending trend line, while momentum indicators such as the RSI are beginning to show renewed bullish signals.

As long as daily trading remains above the 1.1475 support level, the path of least resistance remains to the upside. A confirmed breach and consolidation above the psychological barrier of 1.1600 would likely accelerate bullish momentum, setting the stage for a move toward the next targets at 1.1675 and potentially 1.1720.

Reminder: If the pair falls back and closes below 1.1475, this would delay but not fully invalidate the bullish scenario. In that case, a pullback to retest 1.1420 may occur before any further attempts to resume the uptrend.

Warning: Risk levels remain elevated amid persistent global trade and geopolitical uncertainties. Traders should prepare for heightened volatility, and all outcomes should be considered.

Risk Disclaimer:

With ongoing global trade tensions and key economic data in focus, risk levels remain elevated. Traders should remain vigilant and prepare for potential sharp price swings in either direction.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations