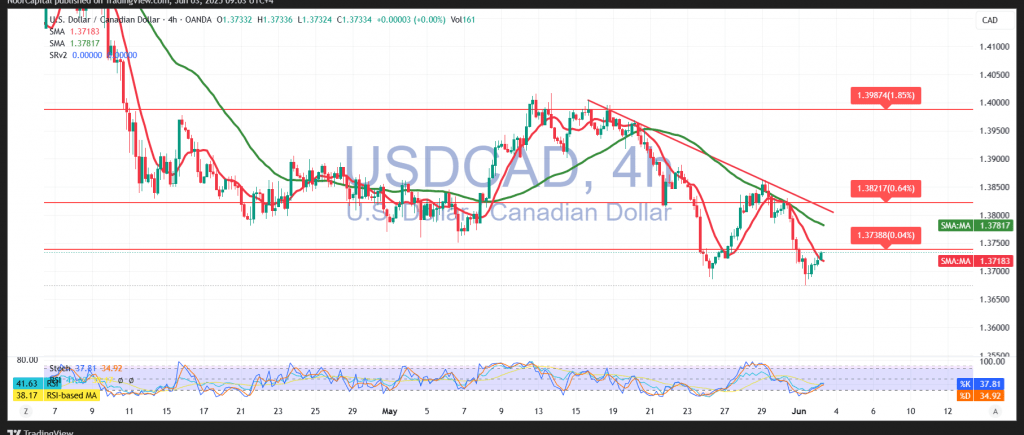

The downtrend continues to dominate the Canadian dollar’s movements, with the pair recording a session low of 1.3674 in the previous trading session—a level that acted as solid support, temporarily halting further losses.

From a technical perspective, the 4-hour chart shows the pair attempting to recover from oversold conditions. However, this potential rebound does not negate the broader daily downtrend, as negative pressure persists from the simple moving averages, which continue to act as dynamic resistance.

There is a possibility for a short-term corrective bounce, targeting a retest of 1.3760 and 1.3785. However, this upward attempt should be viewed as a temporary move within the broader bearish structure. Any failure to hold gains may lead to renewed selling pressure, with downside targets at 1.3650 and 1.3625.

Traders should remain cautious, as the short-term upside potential does not conflict with the dominant downward trend. All scenarios remain possible, and market conditions are prone to volatility.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations