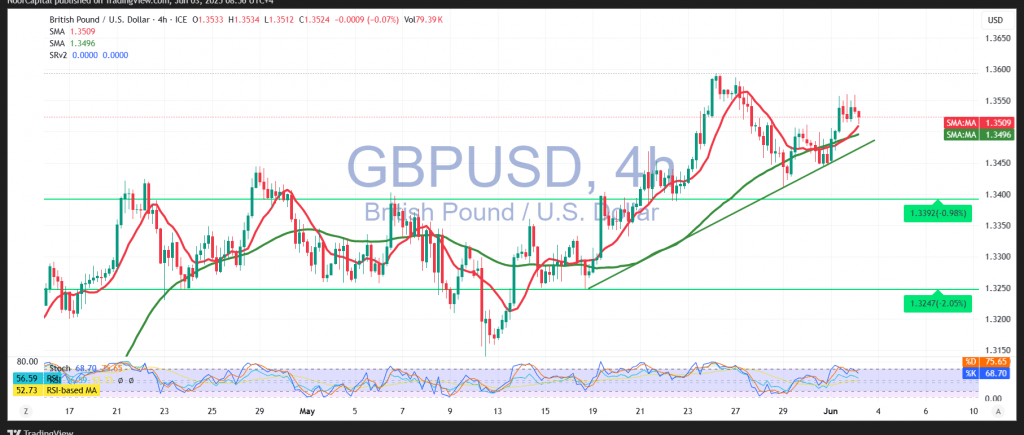

The British pound continued its advance against the U.S. dollar after establishing temporary support above the psychological level of 1.3500.

From a technical perspective, the 4-hour chart shows the pair attempting to clear overbought conditions, while the simple moving averages continue to provide dynamic support, reinforcing the overall bullish trend.

While a short-term correction remains possible as overbought zones are cleared, the broader upside bias is intact. The next target lies at 1.3570, with a confirmed break above this level likely opening the door for an extension toward 1.3620. However, a break below 1.3460 could temporarily delay the bullish scenario.

Traders should remain cautious, as the market remains sensitive to external factors, and risk levels are high amid ongoing global trade tensions. All scenarios are possible, and price volatility may persist.

Disclaimer: Trading in CFDs carries inherent risks. The analysis provided herein is not a recommendation to buy or sell, but rather an interpretation of the current price movement on the chart.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations