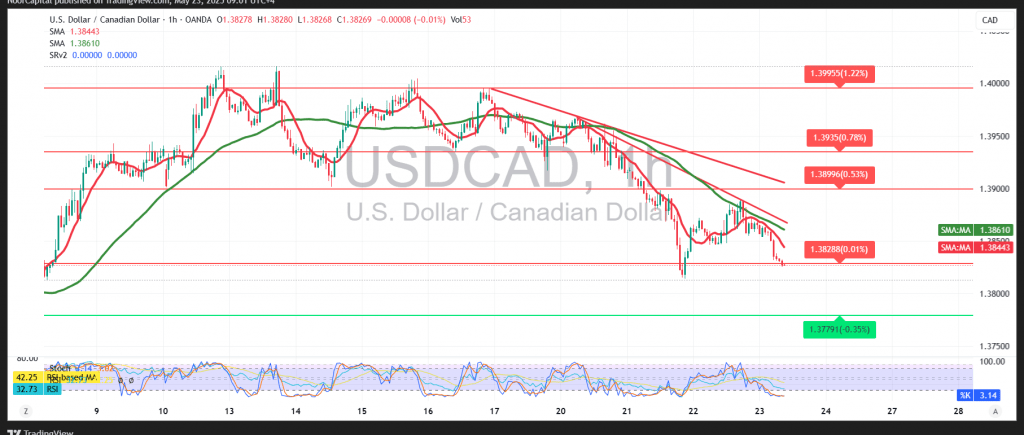

As anticipated, the downtrend continues to dominate USD/CAD, following the pair’s failure to maintain stability above the psychological resistance at 1.3900. This rejection has led to renewed selling pressure and a shift to negative intraday momentum.

From a technical perspective, the 4-hour chart reveals that 1.3900 remains a key resistance level, consistently capping upside attempts. The simple moving averages are aligned bearishly, reinforcing the downside bias, while momentum indicators reflect a clear loss of bullish strength.

With these signals in place, further downside movement appears likely, with 1.3800 as the next critical support and initial bearish target. A confirmed break below 1.3800 could accelerate the decline and open the door to 1.3755 in the short term.

However, traders should proceed with caution, as the pair may experience heightened volatility in response to upcoming Canadian Retail Sales data, a high-impact event that could significantly influence intraday price action.

Risk Disclaimer:

Given current market sensitivity to economic data and the broader risk environment, traders should remain alert and prepared for potential sharp moves in either direction.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations