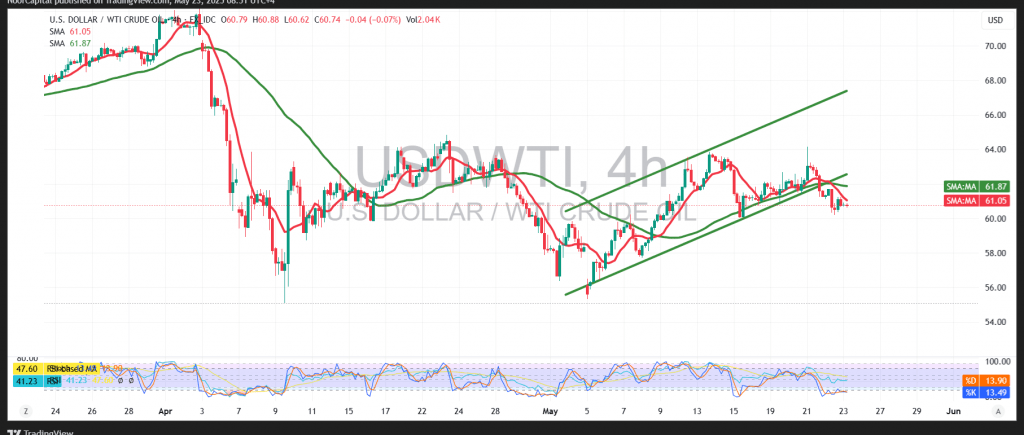

U.S. crude oil futures posted significant losses in line with the previously outlined bearish scenario, reaching the first official downside target at $60.45 and recording a session low of $60.27 per barrel.

From a technical standpoint, oil prices are currently trading below the 50-day simple moving average, which is acting as a strong dynamic resistance around $61.50. Additionally, price action has moved outside the ascending price channel after breaking its lower boundary in the previous session—confirming further technical weakness.

With intraday trading continuing to hold below the $61.50–$61.55 resistance zone, bearish momentum remains dominant. As such, the outlook favors a continuation of the downtrend, with the next target at $60.10. A confirmed break below this level could accelerate losses further, exposing the market to the $59.50 support area.

However, a return to stable trading above $61.55 would be required to negate the current bearish setup and shift the outlook back to neutral.

Risk Disclaimer:

Given ongoing global trade tensions and geopolitical uncertainties, market risk remains high. Traders should remain cautious and be prepared for elevated volatility and potential sharp directional shifts.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. This market’s risk level remains high, particularly due to ongoing geopolitical tensions, which could result in heightened price fluctuations.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations