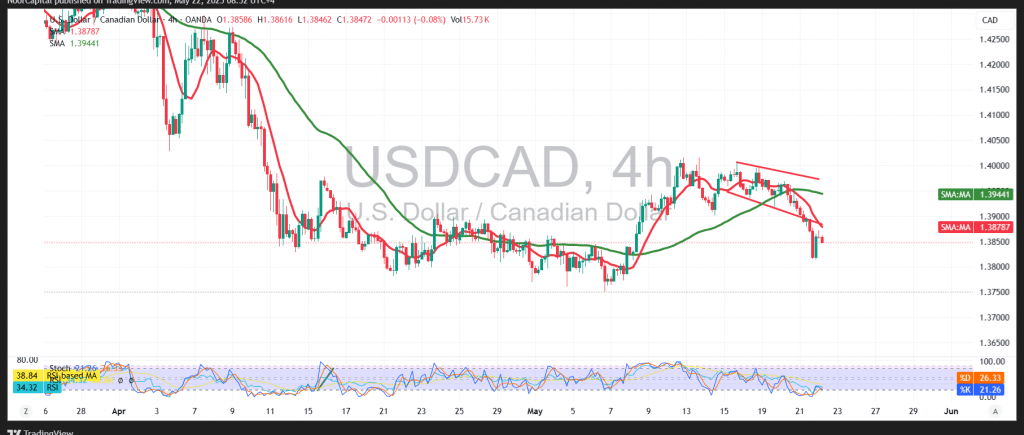

The Canadian dollar came under renewed pressure in recent intraday trading after encountering strong psychological resistance at 1.3900, which triggered a downside reaction and negative momentum.

On the 4-hour chart, the rejection from 1.3900 has been reinforced by the simple moving averages, which continue to act as dynamic resistance levels. This technical alignment suggests limited upside potential in the near term and supports a cautious bearish outlook.

As long as the pair remains below 1.3900, the potential for further downside exists. The initial target is 1.3800, with any break below this level potentially opening the door to additional weakness. However, it is important to note that the pair remains in a range-bound structure, confined between 1.3800 support and 1.3900 resistance.

- A break above 1.3900 could invalidate the bearish scenario and set the stage for intraday gains, with 1.3970 as the next upside target.

- Conversely, a break below 1.3800 would confirm bearish continuation and could trigger an extended decline.

Key Event Risk Today:

Markets are preparing for high-impact Services and Manufacturing PMI releases from the United States, Eurozone, and United Kingdom—events likely to drive heightened volatility in USD/CAD and other major pairs.

Risk Disclaimer:

Given the current global trade environment and the weight of upcoming economic data, market risks are elevated. Traders should exercise caution and prepare for sharp market movements in either direction.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations