The euro advanced against the U.S. dollar in the previous trading session, reaching a session high of 1.1362.

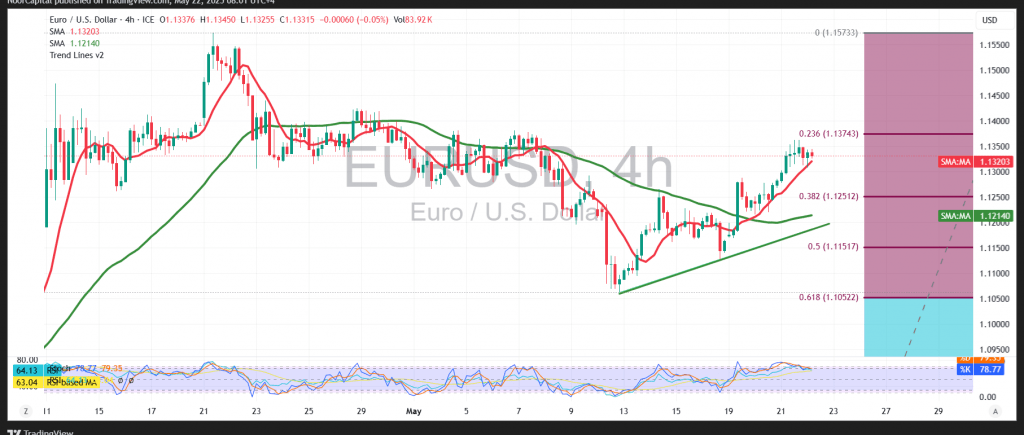

From a technical analysis perspective, the 4-hour (240-minute) chart shows that the EUR/USD pair has successfully consolidated above the previously breached resistance at 1.1255, now acting as support in accordance with the role-reversal principle. The price is also maintaining stability along the ascending trendline, supported by upward-sloping simple moving averages, which are reinforcing bullish momentum from below.

These technical signals suggest a continuation of the upside bias in the near term. A confirmed break above the 1.1370 resistance level, which aligns with the 23.6% Fibonacci retracement, would likely accelerate bullish momentum, opening the way for further gains toward 1.1410, followed by 1.1450.

On the downside, a one-hour candle close below 1.1285, and more critically below 1.1270, could delay the bullish outlook. In this scenario, we may see a corrective move toward 1.1240 and potentially 1.1200 before another attempt to push higher.

Key Event Risk Today:

High-impact economic data releases are expected from the United States, Eurozone, and United Kingdom, including the Services and Manufacturing PMI reports. These releases could trigger significant volatility in EUR/USD and broader FX markets.

Risk Disclaimer:

With ongoing trade tensions and critical economic events on the horizon, risk levels remain high. Traders should be prepared for heightened price fluctuations and multiple potential outcomes.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations