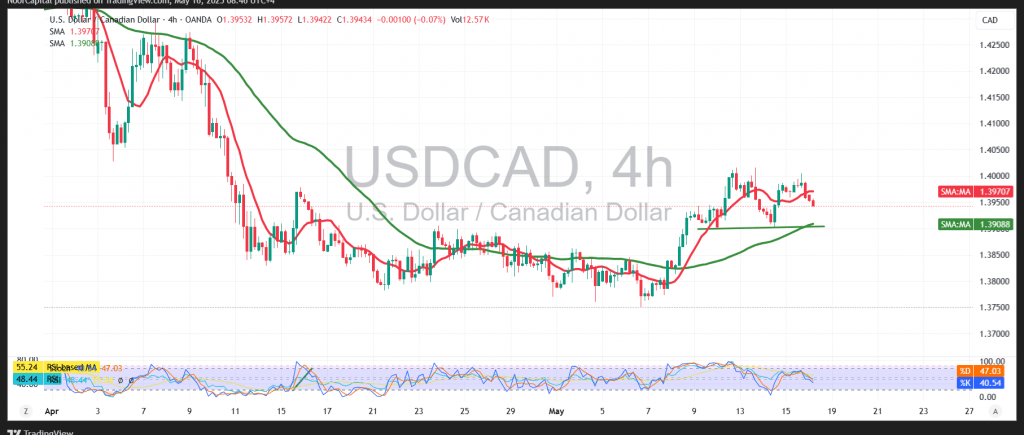

The Canadian dollar has resumed an upward corrective trend after establishing a solid support base The Canadian dollar met its initial upside target at 1.4000, with the pair registering a session high of 1.4004 during the previous trading session.

From a technical perspective, the 1.4000 psychological resistance level has exerted downward pressure, prompting a pullback to stabilize around 1.3945. On the 4-hour chart, the 50-period simple moving average (SMA) continues to provide a bullish signal, suggesting underlying support. However, this is countered by emerging weakness in the Relative Strength Index (RSI), which reflects short-term bearish divergence.

Given the conflicting signals, it is prudent to monitor price behavior closely to determine the next move. Two potential scenarios are in play:

- Bullish Scenario: If the pair holds above the 1.3910 support, the upward trend may remain intact. In this case, a retest of 1.4000 is likely. A confirmed breakout above this level could lead to an extension toward the next resistance at 1.4040.

- Bearish Scenario: A confirmed break and consolidation below 1.3900 would likely invalidate the bullish outlook, placing the pair under renewed downside pressure. This could lead to a decline toward 1.3865, and potentially further to 1.3830.

Risk Disclaimer:

With ongoing macroeconomic uncertainties and global trade tensions, risk levels remain high. Traders should remain cautious and prepare for increased volatility.

Risk Disclaimer: Amid global economic uncertainties and trade tensions, risk levels remain high. Traders should proceed with caution and be prepared for a range of market scenarios.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations