US dollar managed to grasp confidence of investors gradually after positive developments of a potential trade deal between Washington and Beijing throughout last trading week.

The possibility to de-escalate trade war between USA and China after increased US president Donald Trump said that the huge tariffs on China could be “significantly reduced”, but “won’t be eliminated”.

secretary Scott Bessent who said that there will be de-escalation of trade war between Washington and Beijing in the “very near future”.

A Bloomberg report also contributed to the progress of US stocks as it said that the White House is preparing its terms of trade negotiations with UK officials. The report suggested that among the main issues to be discussed by US-UK trade talks is tariffs imposed on cars.

Although China declined there are no bilateral trade negotiations with USA, a Wall Street Journal suggested that China could consider suspending 125% tariffs on its imports from the American side.

This softer tone used by Trump in speaking about his stance from China could be a turning point of trade relationship between the two countries.

Markets viewed these statements as a potential turning point that could elevate trade relations between Washington and Beijing, fostering stabilization and prosperity. This optimistic outlook bolstered risky assets, particularly global stocks.

When this tone is put side by side with bilateral negotiations among USA on one hand and India, UK, and Japan on the other, this can be regarded as setting the stage to a truce to stop trade war, at least on temporary basis, and hence reaching more fair trade deals among USA and its trade partners, which is very healthy for global economy environment.

US Stocks made use of 3 things

US stocks made remarkable gains last week buoyed by the soft tone used by US President Donald Trump and other official in his administration regarding US-China trade relations.

The shares also were pushed higher by statements of some Fed’s official who were inclined to further rate cuts.

They found support in Beth Hammack and Christopher Waller, fed’s governing council members. Hammack expected a rate cut in June which Waller showed support to rate cut in case tariffs lead to lower job growth.

The third thing was earning reports, although adopting negative tone, some of them added a lot of upside momentum to NYSE indicators.

Although a number of companies – released their earning reports last week – announced negative outlook, Alphabet, the Google’s parent business group, made stronger than expected revenues and earnings.

Gold is out of steam

Gold ended the last trading week lower as it lost upside momentum due to dollar strength and the correction move taken by the yellow metal.

The slump of the precious metal was also negatively impacted by return of confidence in US assets after optimism around a potential trade deal between USA and China pushed these assets in the uptrend last week.

Increasing demand on safe haven was also there, but this time it played in favour of the greenback, the Japanese yen and Swiss Franc, which has taken from gold’s share of safe haven group.

European currencies slump

Although euro and British Pound made gains in the first half of last week, they were pressured by dollar recovery throughout the second half of that period.

The two currencies were impacted by other factors such as the pressure faced the single currency after Christine Lagarde, ECB governing council head, and other member of the council – like Robert Holzmann, suggested that the central bank is inclined to more rate cut.

Wall Street Journal said Friday that China is considering suspension of 125% tariffs on US goods, including medical equipment and industrial chemicals, which bosted the US dollar.

ECB’s Rehn said that inflation in the eurozone is likely to slowdown because of Trump’s tariffs, which added to further negative impact on the euro.

Bitcoin added more than 10%

Bitcoin was the biggest winner in financial markets as it added 10% gains last week buoyed by improvement in risk appetite.

The cryptocurrency made use of its positive relation to S&P500 stock index, which flied high throughout last week’s sessions.

Bitcoin notched ended weekly trading on April 25 at $93994 versus $85198 reached the week before. The weekly low of such period was $85134 while the weekly high was $95857.

This week

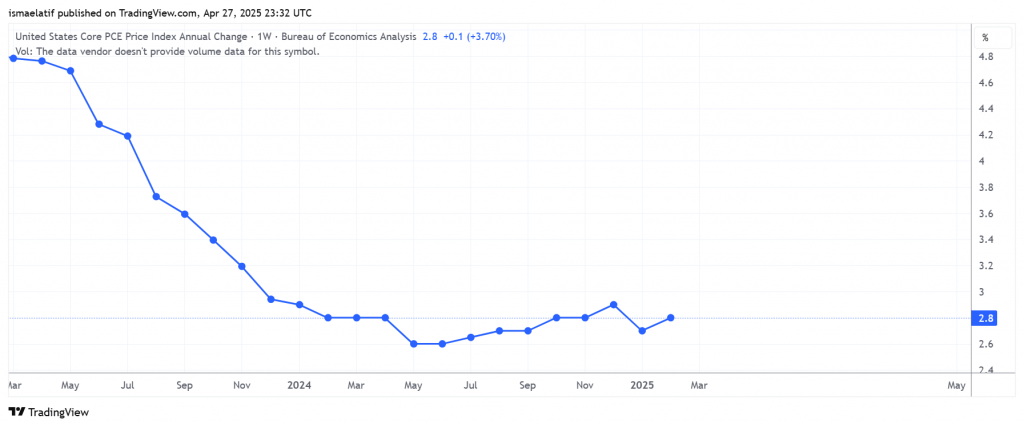

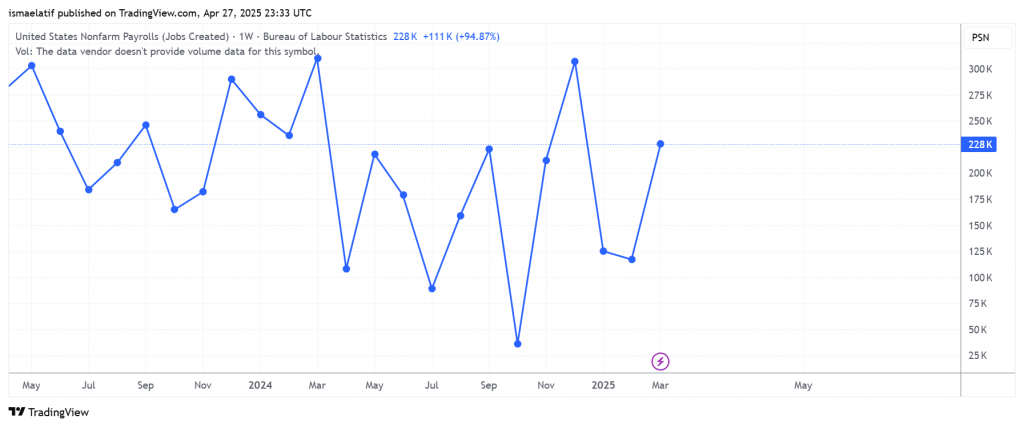

The new week is a busy one as markets are anticipating important data, including PCE readings – the most credible and reliable inflation indicators for the Federal Reserve – and NFP as well as other important jobs data which act as strong market mover every month.

Significant earning reports are to be released this week, including a number of the “Mag7”, the technology giants, Amazon, Microsoft, Meta platforms, and Apple.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations