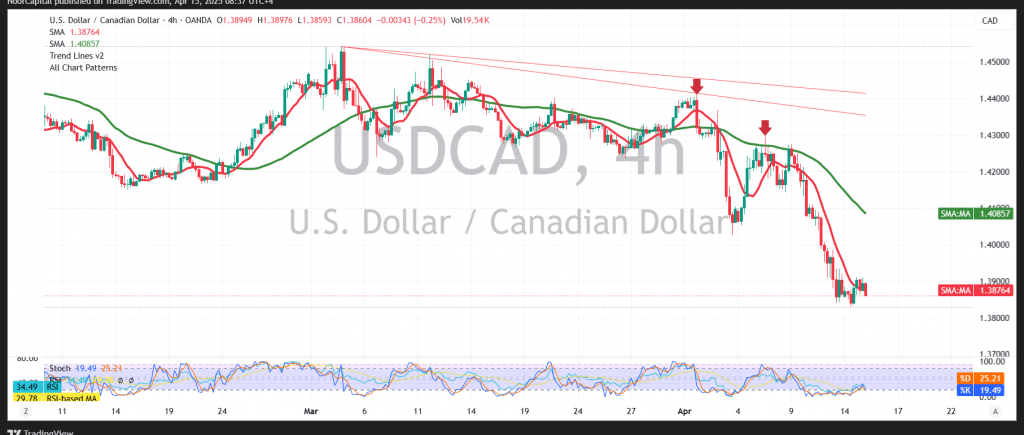

The Canadian dollar remains under sustained downward pressure, with the pair extending its losses over several consecutive sessions and reaching a recent low of 1.3828.

From a technical standpoint, the 4-hour chart confirms the continuation of the dominant downtrend. Price action remains firmly below the key simple moving averages, which are acting as strong dynamic resistance levels and reinforcing bearish momentum.

As long as the pair remains below these resistance zones, the bearish outlook is favored. A continued decline toward the immediate support at 1.3820 is likely. A confirmed break below this level could accelerate the downside move, targeting 1.3785 followed by 1.3740.

However, a break and sustained price consolidation above 1.3910 would challenge the current bearish scenario. In such a case, we may see a corrective rebound toward 1.3950 and possibly 1.3970.

Risk Disclaimer: Market conditions remain volatile due to broader economic and geopolitical uncertainties. Traders should stay alert and manage risk carefully, as price swings may be sharp and unpredictable.

This analysis is for informational purposes only and does not constitute financial advice. Trading foreign exchange involves risk, and traders should always conduct their own research and exercise caution.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations