The EUR/USD pair remains confined within a narrow sideways range, with a slight bearish bias, after touching a recent low of 1.1296 in the previous session.

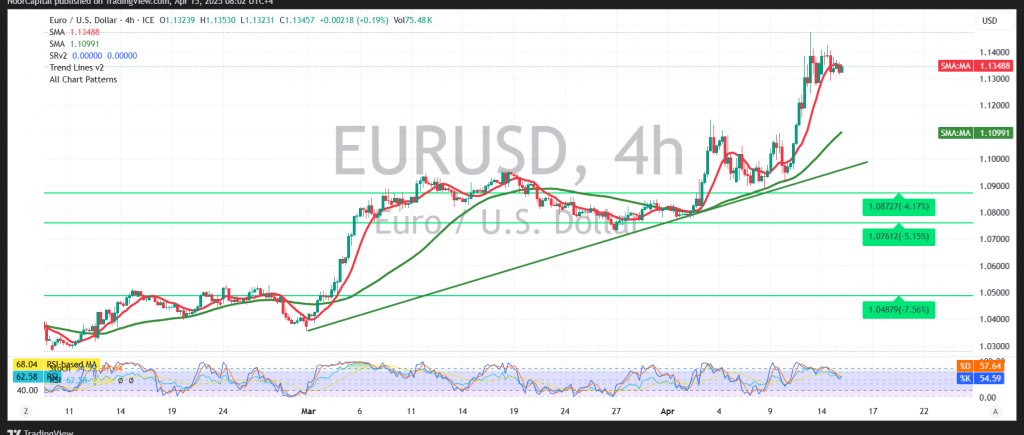

From a technical standpoint, the 4-hour chart shows the Relative Strength Index (RSI) beginning to ease out of oversold conditions, suggesting a potential shift in short-term momentum. Meanwhile, the pair continues to trade above the simple moving average, which is acting as a supportive demand zone.

As long as intraday price action holds above the psychological support level at 1.1300—and more broadly above 1.1270—the bullish outlook remains intact. In this scenario, the next upside target lies at 1.1420, with a breakout above this level likely paving the way for a further move toward 1.1485.

Conversely, a confirmed move below 1.1270 could introduce renewed bearish pressure, exposing the pair to a potential retest of the 1.1230 support area.

Risk Disclaimer: Given the current market climate, marked by ongoing trade tensions and macroeconomic uncertainty, volatility may remain elevated. Traders should be prepared for a range of potential outcomes.

Risk Disclaimer: Market conditions remain uncertain amid ongoing trade tensions, and traders should be prepared for all possible scenarios.

⚠ Risk Warning: The market remains highly volatile, and all scenarios should be considered.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations